In the afternoon of October 26, heavy news was revealed in the market. Media reports stated that ByteDance's Douyin business plans to be listed separately in Hong Kong. The relevant person in charge of ByteDance responded that he is considering some business listing plans, but has not yet been finalized.

It is interesting to note that just a few days ago, another giant Kuaishou , which is on the same short video track as Douyin, was also revealed to be listed in Hong Kong in the first quarter of next year. This means that there is no fixed number of who will receive the first short video.

As the "two poles" in the short video field, the DAU of the Douyin system exceeds 600 million, and the DAU data of the Kuaishou system in January this year exceeded 300 million.

According to third-party data, Douyin and Kuaishou have covered 87% of domestic Internet users. Douyin and Kuaishou's penetration increase in the number of users has been extremely limited. To a certain extent, it is extremely difficult for Kuaishou to catch up with Douyin's daily activities, and it is even difficult to see the possibility.

If the first half of the short video war is a competition between Douyin and Kuaishou against users, it is clear that the winner is already divided, with Douyin first and Kuaishou second.

After the end of the first half is set, enter the second half of the short video field, Douyin and Kuaishou will compete on the business ecology and capital level generated by users.

In the second half, the business ecology of Douyin and Kuaishou is moving from the initial differentiation to the highly competitive. From the current point of view, Douyin's revenue growth and the formation of an ecological closed loop trend are more obvious. Kuaishou still needs to use its own characteristics to catch up.

In addition to business and ecology, both Douyin and Kuaishou have announced their listing plans, indicating that the two parties will also compete for the favor of investors in the capital market. Earlier news reported that Kuaishou is currently valued at US$50 billion. Under the benchmark, what record will Douyin's valuation set?

In the second half of the short video, Douyin and Kuaishou will compete in all aspects of business, ecology and capital.

The crucial battle has already begun.

The end of the first half and the beginning of the second half of the "shaking, fast" battle

Douyin and Kuaishou are both short video applications that are deeply oriented to the C-end group. Since they are oriented to the C-end, the user base is undoubtedly the most important and fundamental key variable. This is also a key indicator for judging the victory or defeat of Douyin and Kuaishou in the first half of the short video field.

In terms of birth time, Kuaishou is obviously earlier. Its predecessor can be traced back to a tool-based application for making and sharing GIF images, which was born in March 2011. One year later, in November 2012, Kuaishou began to switch to the short video community. In 2014, it was officially renamed Kuaishou. It took three years for Kuaishou to increase its DAU from 10 million to 100 million. In January this year, Kuaishou announced that DAU exceeded 300 million.

Compared with Kuaishou, Douyin was born five years later, but it quickly overtakes corners, which can be described as "a miracle vigorously".

Since ByteDance launched the Douyin App, a music short video community for young people, in September 2016, Douyin has developed rapidly. From 2017 to 2019, Douyin exceeded 200 million daily activities in two years, surpassing Kuaishou to become the industry's first . As of August this year, the DAU of Douyin Short Video, Douyin Speedy Version, and Douyin Volcano Version have reached approximately 600 million, widening the gap in daily active data with Kuaishou.

According to third-party data, as of June this year, short video users have exceeded 810 million, infiltrating 87% of Internet users, and the user’s duration of use has stabilized at 8.8%.

This means that both the number of users and the length of user time, the upward growth of the short video industry is close to the ceiling, and the overall upward penetration is extremely difficult.

So far, from the user base level, Douyin and Kuaishou have become "two poles" with 600 million and 300 million daily activities respectively.

If the competition for the first half of the short video industry revolves around the user base, then it is clear that the first half has a high probability of being over, and the winner has already been divided, Douyin first, and Kuaishou second.

The end of the first half must mean the beginning of the second half. In the second half, in what dimensions will Douyin and Kuaishou compete? Can Douyin, who maintained the lead in the first half, still win in the second half?

Various signs indicate that after the large-scale competition between Douyin and Kuaishou at the user level is a foregone conclusion, the two parties are launching a "competition" around the user's business ecology in the second half.

The core of the business ecology competition is the user experience and commercial value it brings.

In terms of user experience, whether Douyin, which "records a good life" or Kuaishou, which "embraces every life", strives to provide users with the ultimate experience. I will not list which one is better, maybe the number of users is already an answer .

In the core commercial value, the competition between the two will be related to the choice of investors, the valuation of the capital market, and the market structure in the second half.

The key battle for capital, who will win?

As mentioned above, in the second half of the competition in the short video field, Douyin and Kuaishou will focus on the deepening of the business ecosystem and the commercial value behind it. The embodiment of commercial value in a higher dimension is the recognition and valuation given by the capital market.

The listing plans revealed by both Douyin and Kuaishou indicate that at the time of the IPO, the two parties are already racing and both have IPOs in the Hong Kong market. The two parties have "staged" investor disputes and valuation disputes. "The drama" taste.

According to media reports, Kuaishou's current valuation is about US$50 billion. Under the benchmark, what record will the valuation of Douyin's business in Hong Kong set?

Starting from the common sense of the capital market, whether it is the battle for the first share of short video or the battle for valuation, the core foundation is to return to the current status and future expectations of the commercial value of Douyin and Kuaishou.

At the beginning of its establishment, Douyin and Kuaishou's income composition were very different. However, today in the second half, the revenue composition of the two parties has begun to be fully competitive, mainly focusing on advertising revenue, live broadcast revenue, and e-commerce revenue.

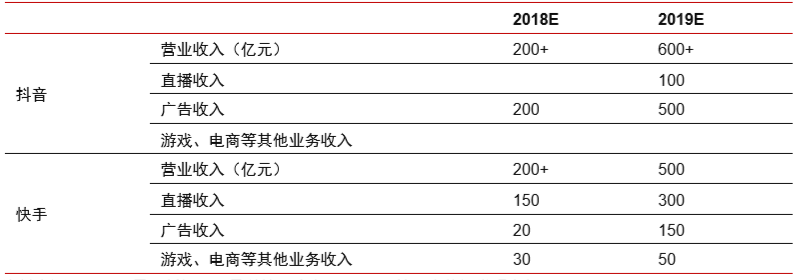

The following table is derived from the research report data of many media and brokerage companies. Although the data is not fully disclosed and estimated revenue, it can be seen that Douyin and Kuaishou are competing in commercialization.

As can be seen from the above table, compared with Kuaishou, Douyin's revenue has changed from flat to over. As of 2019, Douyin's annual revenue exceeded Kuaishou by more than 10 billion yuan.

In terms of revenue structure, both are working on advertising, live broadcasting, and e-commerce. In the foreseeable time period, whoever runs faster in these three modules will be able to take the lead in the second half.

Look at advertising revenue first. There is no doubt that this is a battleground where both are extremely dependent.

According to data from iResearch, the scale of mobile Internet advertising in 2019 was 541.5 billion yuan. By 2022, the scale of mobile advertising is expected to reach one trillion yuan.

In mobile Internet advertising, the proportion of information flow advertising is expected to further increase to 44.8%, which means that by 2022, the scale of information flow advertising is expected to be close to 500 billion.

Regarding information flow advertising, Toutiao has been monetized by ad placement into information flow since 2013. It can be said that Bytedance has accumulated in the information flow advertising business for many years, and Douyin also tried information flow advertising at the end of 2017. Currently, Douyin relies on the recommendation mechanism and operational capabilities to provide users with an immersive viewing experience, providing the possibility of high conversion rate and high effect for information flow advertising.

In information flow advertising, Kuaishou is also catching up quickly, but judging from the current data, there is still a considerable gap between the two sides. For example, in 2019, Kuaishou’s advertising revenue was 15 billion, and Douyin’s advertising revenue reached 50 billion.

Whether it is Google or Facebook, advertising revenue is the core. This may be one of the ultimate means of Internet companies' market value competition. From this perspective, Douyin's advantages are more obvious.

Looking at live broadcast income, compared with Kuaishou, Douyin entered live broadcast relatively late, and there is a gap in income. But by 2019, Douyin live broadcast has reached 10 billion-level revenue.

According to third-party data, in February 2020, the number of Douyin and Kuaishou users who watched live broadcasts accounted for 28.2% and 50.4% of active users, respectively. Douyin increased by 4.2 percentage points from the previous month, and Kuaishou was basically the same. In terms of anchor gift income, Douyin rewards income has grown rapidly, while Kuaishou is relatively stable.

Industry expectations, vibrato overlay user base advantage and increase long excellent potential, is expected to reduce revenue and deft live in.

Looking at the e-commerce business, this is also the most important battlefield for Douyin and Kuaishou this year.

E-commerce is a super-large track. Super players such as Alibaba , JD.com, and Pinduoduo have been accommodated on this track , and the capacity of the e-commerce track is still expanding.

For Douyin and Kuaishou, whether the advantages of users, traffic, and content can be transformed into potential energy in the e-commerce field will become an important section affecting capital market valuation. This year, Douyin and Kuaishou called out the goal of 200 billion and 250 billion GMV respectively.

External public information shows that from January to August 2020, Douyin e-commerce payment GMV increased by 6.5 times. Kuaishou said that e-commerce orders exceeded 500 million in August. In the past 12 months, the total number of orders of Kuaishou e-commerce Second only to Taobao, Tmall, JD, and Pinduoduo.

The competition between Douyin and Kuaishou in the e-commerce business has become fierce. It is worth noting that e-commerce business covers many fields such as supply chain, financial payment, etc., and its complexity is very high. For Douyin and Kuaishou, whoever can form an ecological closed loop in many fields and bring users a better experience will have more probability of winning in the e-commerce business competition.

At present, Douyin is moving faster in building a closed-loop business.

A research report by a brokerage firm pointed out that at the level of e-commerce infrastructure, for example, in the early stages of e-commerce development of both parties, the network, cloud computing, and payment were all or partly from third parties, which led to poor payment and network in the early stage of live e-commerce. Phenomenon such as delayed freezing. However, with the increase in capital expenditures of both parties in infrastructure, such as the construction of Kuaishou data center, the platform infrastructure capabilities of both parties continue to strengthen. At the payment level, Douyin is the first to obtain a payment license, which also means that Douyin will achieve commercial closed loop faster than Kuaishou.

On the whole, in the advertising business, Douyin has obvious advantages, and the space for both parties to penetrate is huge; in terms of live broadcast revenue, Kuaishou dominates, and Douyin is trying to catch up; in the e-commerce business, the two parties are competing to build a commercial closed loop At present, Douyin has taken the lead in completing the layout of an extremely important part of payment.

Taking now as the time node, if the valuation is solely based on business income, from the estimated figures in 2019, it is obvious that Douyin is higher than Kuaishou. If Kuaishou’s current valuation is $50 billion, Douyin should be how much? I believe it will also be a record number.

Looking at the future from now, what the capital market needs to evaluate is the development trend of the business ecology of both parties. Who will win? Or how many wins? I believe that with the listing of both parties, the capital market will soon give an answer.

No comments:

Post a Comment