This year, the chip giant Intel has not had a good life. First, the 7nm chip was postponed again, then it outsourced cutting-edge technology, and recently sold its NAND memory business. All these have aroused the market's worries, how Intel's performance, the latest financial report gives some answers.

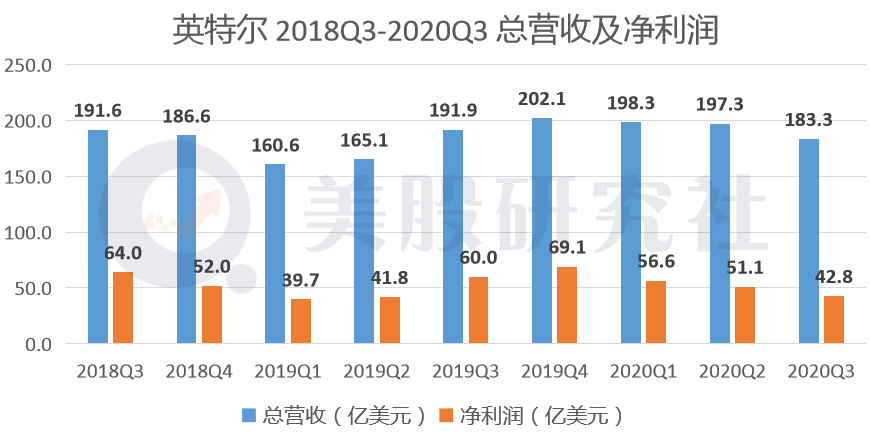

After the US stock market on October 22, Intel announced its performance report for the third quarter of fiscal year 2020. According to the financial report, Intel’s revenue for the quarter was US$18.33 billion, down 4% year-on-year, slightly higher than market expectations in July; net profit was US$4.28 billion, down 28.6% year-on-year; core business data center revenue was US$8.422 billion, A year-on-year decrease of 10%.

Affected by the financial report data, Intel's stock price fell 9.37% after the market, the stock price hit US$48.85, and the market value was US$229.237 billion.

Although revenue is higher than expected, it is still difficult to change the fact that its performance growth is weak. However, the core business data center has changed from the high growth rate of the previous quarters, but it has shrunk this quarter, which may become the key reason for the stock sell-off.

(Source: Snowball )

Intel failed to deliver a satisfactory answer sheet this quarter. The performance of the last quarter was good, but the stock price fell sharply due to the delay of the 7nm chip. There were also many problems in the performance this quarter. With AMD, Nvidia and other giants taking advantage of the chase, Intel has obviously become more passive. In the fiercely competitive market environment, which of Intel’s current financial statements are worthy of recognition or insufficiency?

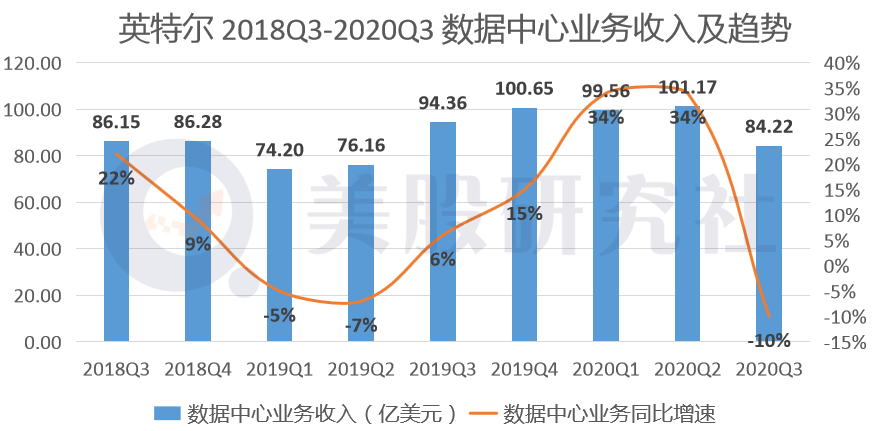

The weakening of data center business drags down revenue, and the decline in corporate government spending may be the main reason for the decline

The data center is Intel’s core business in recent years, accounting for approximately 46% of total revenue this quarter. Compared with the ratio of more than half in recent quarters, there has been a significant decline.

Intel increased its data-centric product line last quarter, introduced a new generation of processors, and hardware and software AI-related product portfolios, with the intention of increasing its customer acquisition capabilities. The company has prioritized more resources to its innovative business, but it is currently not getting the same return.

The financial report shows that the data-centric business this quarter was 8.422 billion U.S. dollars, down 10% year-on-year and 16.8% month-on-month. The benefits of cloud office, cloud education and 5G network in the last quarter have had a positive impact on Intel's core business, but the positive effect brought by the market has not been continued this quarter.

among them:

The Data Center Group (DCG) contributed US$5.9 billion in revenue, a year-on-year decline of 7%;

The Internet of Things Group contributed US$677 million, a year-on-year decrease of 33%;

Revenue from the autonomous driving business was US$234 million, a year-on-year increase of 2%;

The decline in the revenue of the Data Center Group (DCG) department is the main reason that drags down the overall data-centricity. Among them, DCG's revenue from corporate and government market segments fell by 47% year-on-year in this quarter, ending the high growth trend of over 30% growth for two consecutive quarters.

According to Intel executives disclosed in the financial report, the economic weakness caused by the epidemic has inhibited the demand for data centers from global companies and governments.

Previously, Dell'Oro Group data center capital expenditure research director stated in the second quarter that the epidemic is expected to severely disrupt the global demand for data center infrastructure equipment this year. At present, the vertical industries that have been hit by the economy, especially the physical retail industry, tourism, hotel industry, and small and medium-sized enterprises, have tightened IT expenditures, and resumed related expenditures after waiting for the business environment to stabilize.

This means that in the short term, companies or government departments will also tighten their funding related to data centers. In such a market environment, it is not difficult to understand Intel's data center business revenue decline this quarter. Starting with Intel, perhaps this also means that AMD and Nvidia’s data center business revenues in the new quarter are also facing a downward risk, and the performance of cloud-related giants such as Microsoft and Amazon may also be affected.

It is worth mentioning that Intel is currently in the process of strategic transformation with the data center as the core, stepping into new areas and launching related products, which has dragged down the short-term performance of overall gross profit margin. Data show that Intel's gross profit margin was 53.1% this quarter, a 5.8 percentage point decline from 58.9% in the same period last year.

Looking back at multiple quarters, it can be found that its gross profit margin has shown a downward trend since the third quarter of 2018, which may reflect from the side that Intel has gradually lost its right to speak on prices in the industry.

AMD's current chips are further improved in energy consumption under the support of TSMC's technology. Intel's advantages are gradually shrinking, and the once high product prices have discouraged many users. The recent price reduction strategy to deal with AMD's impact on the chip business has undoubtedly exacerbated the decline in gross profit margin. If the speed of product development continues to be inferior, it may be difficult to see a rebound in the short term.

This year, Intel's competitors have achieved certain breakthroughs in the data center business. Since AMD returned to the server processor market, although it has not disclosed the specific data of its data center business in detail, its market share continues to expand or reflects the growth trend of the business from the side.

Affected by the decline in Intel's data center business, AMD's stock price rose nearly 3% after the market yesterday, and the market seems to give Intel's competitors higher performance expectations.

Nvidia has been increasing its data center business recently. At the recent GTC conference, the company announced the launch of the Data Processing Unit (DPU) to take over more tasks in the data center and announced plans to develop new chips, aiming to compete for more market share from its main rival Intel CPU.

At present, Intel's competitive landscape is not optimistic. As its emerging business, the data center will still face new competitors. The data center business is developing rapidly, but there are still uncertainties in market demand. This also means that Intel's data center products are not the only choice in the market.

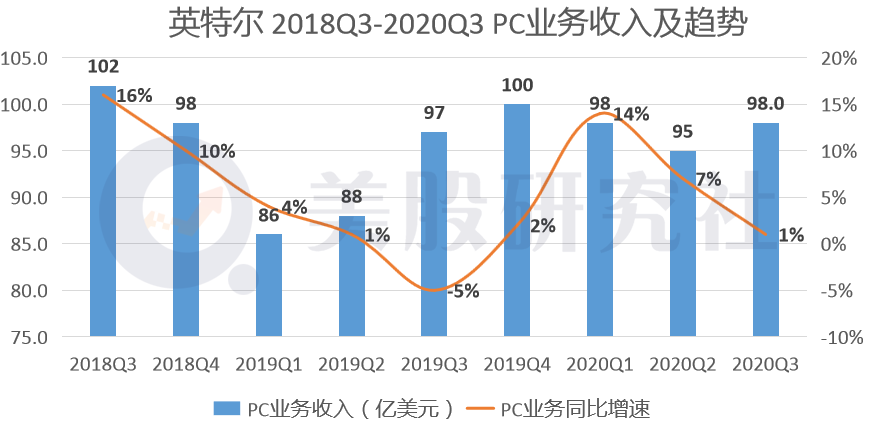

PC business is in a "middle-aged crisis", AMD's "grabbing" hard to raise water

The data center business is Intel's future, and PC, as the company's old business, is still valued by Intel. The PC business is still the company's "cash cow". The financial report shows that the PC business revenue in the third quarter was 9.8 billion US dollars, an increase of 1% year-on-year.

Affected by remote home office, demand for personal mobile PC products has increased, while demand for desktop PC products has been suppressed. At Thursday’s earnings report, Intel’s Chief Financial Officer George Davis said that demand for personal computers has shifted from desktops and high-end commercial PCs to consumer-grade and educational products. Therefore, despite sales growth, the average selling price has fallen, affecting profit .

It is undeniable that PC, as an established business, has gradually lost its momentum for rapid growth, and its growth has gradually stabilized. But Intel is also facing competitive pressure from AMD when occupying a stable market share in the PC market.

In the second quarter, AMD’s revenue from the computing and graphics division was US$1.367 billion, higher than the US$940 million in the same period last year. In fact, AMD has maintained substantial growth in the PC business for several consecutive quarters.

The PC business contributed US$1.44 billion in revenue in the first quarter of this year, a year-on-year growth rate of 73%; in the fourth quarter of last year, it contributed US$1.66 billion, a year-on-year growth rate of nearly 69%. And this year AMD's launch of processors based on the Zen 3 architecture is bound to seize part of Intel's market share.

In addition, at the end of June, Apple officially lost its major customer. In two years, Apple will transfer MAC to custom-designed ARM-based chips, which will undoubtedly inhibit the growth of Intel's PC business.

In general, the data center business, which has attracted much attention from the market, has not delivered a high-growth report card, and the PC business revenue has stabilized and it is difficult to give the imagination of high-growth. In front of Intel, what urgently needs to be solved may be the production problem of new chips, which lags behind industry rivals in terms of manufacturing technology, and its own 10nm and 7nm processes cannot keep up with the rhythm, and will fundamentally lose some of its competitive advantages.

AMD and Nvidia beat up the chip arms race, Intel still has Apple's growth strength?

Under the strong offensive of competitors, Intel has made many moves in the sale of assets and acquisitions, and has shown its anxiety in manufacturing technology.

Intel, which once regarded the memory chip business as one of the six pillars, recently announced that it would sell its flash memory business to SK Hynix.

The poor performance of the flash memory business may be one of the reasons for its sale. Although the market has expressed concerns about Intel’s performance decline in the sale, the US Stock Research Agency believes that the divestiture of non-core businesses will provide Intel with sufficient free cash flow and help it to seek development in core businesses. In the long run Not a bad thing.

Its own business expands to artificial intelligence, edge computing, etc., and these businesses require a lot of capital investment. Making adjustments to the business strategy and selling low-yield businesses can increase Intel's overall earnings.

History always seems to be surprisingly similar. Intel’s plan to sell the only Chinese fab to SK. When AMD was in a business crisis many years ago, it chose to sell its fab in exchange for funds, thus gradually expanding its PC business. Market position. Whether Intel can bring unexpected results this time is also worthy of attention.

Nvidia previously acquired Mellanox for US$6.9 billion to obtain its network technology, and it was reported that it acquired Arm for US$40 billion to obtain its excellent computing capabilities; AMD subsequently said that it is discussing acquisition plans with FPGA chip manufacturer Xilinx, and FPGA is to develop 5G communications. , Data center, an important part of the driverless market. Obviously, the acquisition attempts of these two giants are all aimed at the data center business that Nvidia focuses on.

While competitors have announced acquisition plans, the huge shock in the chip industry has continued. Intel’s sale may be a powerful counterattack to competitors.

Intel has deployed in 5G, autonomous driving and other fields, and is expected to bring greater imagination on the basis of its current performance.

With the transition of the telecommunications industry to 5G, the next round of network transformation may give rise to a $25 billion chip market. Intel currently provides hardware, software and solutions for 5G network infrastructure, and is expected to seize the new opportunities brought by 5G.

Intel’s subsidiary autonomous driving Mobileye has won large orders from Ford, Geely and other automakers this year, and Qualcomm and Nvidia grabbed the market share of autonomous driving. Cooperate with transportation operator WILLER to deploy autonomous driving tests to multiple countries or regions. Although mobileye currently accounts for relatively small revenue, it has huge growth prospects from a trend perspective.

At present, the market as a whole is optimistic about Intel's growth prospects, but it is lower than expected in the first half of the year. At present, a total of 43 analysts have made a rating, which is a comprehensive "hold" rating, which is further downgraded from yesterday's "hold" rating. This may mean that Intel's subsequent performance growth is still facing considerable pressure.

Source of this article: US Stock Research Institute, please indicate the copyright

No comments:

Post a Comment