Smartwatch players can be divided into three factions, however, no matter which faction, they cannot escape the routine.

"It can watch the time, it can not only watch the time." Just looking at this ad slogan, do you know that this is an Apple iWatch ad?

In 2013, the American company Pebble released the world's first smart watch. After a hot period, the market gradually cooled down due to its single function. In 2017, the "sports health function" was introduced into smart watches, coupled with the emergence of independent networking, allowing smart watches to be separated from mobile phones and become truly independent devices.

In 2019, with Google's high-profile announcement of the US$2.1 billion acquisition of Fitbit, the originator of smart bracelets (Fitbit acquired Pebble, the originator of smart watches), and the entry of more new players, smart watches ushered in the second spring.

Who is entering the second spring?

With the difficult changes in smartwatch products, the old players have partially ended, and a lot of new players have replaced them.

In addition to Google’s acquisition of Fitbit, the second ignited hopes for smart watches. The domestic smart hardware representative Xiaomi also launched the first smart watch in November of the same year. The embarrassing thing is that once it was released, it was questioned that "plagiarism" had already entered the game. apple;

In March 2020, OPPO launched the first smart watch "OPPO Watch"; in September, vivo officially released the first smart watch "vivo Watch".

In the first spring, due to factors such as the system's failure to keep up, the single functional application, and the high degree of homogeneity with mobile phones, with the passing of freshness, smartwatches ushered in a low tide in 2016, with annual sales only over the previous days with an increase of 1 percent.

During the low tide, some manufacturers that were the first to be "the first batch of crab eaters", such as Microsoft, Google, Motorola, etc., decided to temporarily or permanently exit the track, "We have not seen the sales performance of smart watches. It is attractive enough to release new smart watches with Android Wear 2.0." Motorola, one of the "crab-eaters", said publicly at that time.

At this point, the first batch of smart watch players finally scattered and stayed.

Until 2017, the emergence of the "sports health + independent networking" combination pulled smart watches from the low tide. This can be seen from the sales volume. In 2017, 2018, and 2019, 29.3 million units, 45 million units, and 62 million units were shipped respectively, achieving a year-on-year increase of 38.8% and 53.6%. Among them, Apple Apple Watch leads a lot of players with absolute advantage.

Three martial arts of smart watches

After the first wave of turmoil, the current smartwatches are ushering in the second wave of excitement. As far as mobile phone manufacturers are concerned, those with names on the shipment statistics list have developed smartwatch product lines.

In terms of the nature of the current manufacturers, smartwatch players can be divided into three factions, namely mobile phone manufacturers, AI startups/Internet companies, and traditional watch manufacturers.

Mobile phone manufacturer

In detail, there are no less than 9 mobile phone manufacturers currently on the smart watch track. Specifically, they include Apple, Samsung, Huawei, Xiaomi, OV, Lenovo, ZTE, and Motorola, which is returning again.

As mobile phone manufacturers, they have a natural advantage in that they can attribute smart watches as part of the mobile phone ecology, and use the linkage between smart watches and smart phones to push the product closer to consumer groups.

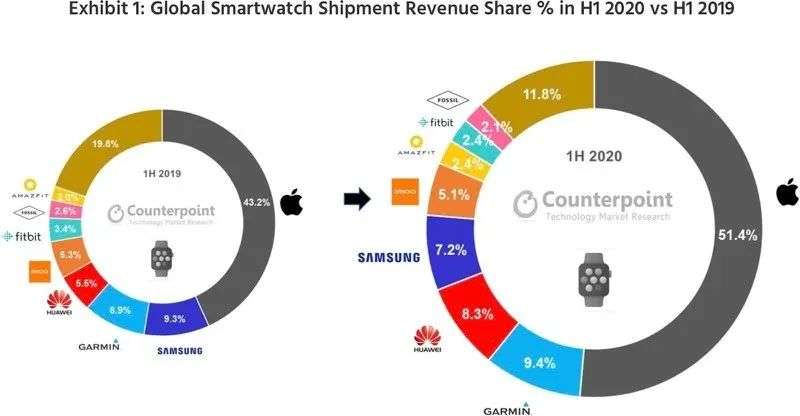

Functionally, the design of smart watches by mobile phone manufacturers is based on "sports and health functions". In terms of market segmentation, Apple Watch took the lead and won half of the global market share, followed closely by Huawei and Samsung with names on the statistical list. Other mobile phone manufacturers are classified as others.

AI startup/Internet company

There are 4 representative companies of this sect, namely Jiaming, Xiaotiancai, Huami and Fitbit.

Among them, Garmin's excavation of health and sports functions can be said to be an important contributor to the rise of smart watches.

Another thing worth paying attention to is the little genius. The main highlight of "child care" sets it apart from the other three. It has also successfully captured the huge stock market of children. It once became a smart watch with shipments second only to Apple. Brand.

Due to the lack of the natural advantage of smart phones, although the products of AI startups/Internet companies such as Jiaming, Huami and Fitbit are also directly oriented to consumer groups, the threshold also exists.

Under this premise, if you want to gain sales, you will either be like a small genius, or target a more vertical group, or seek orders from the B-end market. For example, Garmin chose the first one to organically integrate GPS navigation with the health industry, creating dozens of series and dozens of categories of smart wearable products, which have been well received by outdoor sports enthusiasts and professional athletes.

In addition, in the B-side business, around the current smart watch heart rate monitoring and other functions, scenarios such as hospitals will also be a good market choice.

Traditional watch maker

Representatives of this school are Fossil (fossil), Casio, etc.

Compared with the other two sects, this sect does not pay so much attention to sports health in product design. For example, Fossil, it may also be equipped with sports modes, heart rate monitoring, etc., but it is more concerned with trend factors.

The combination of "technology + fashion" also gives more possibilities to the smart watch, a piece of smart hardware. With this combination, perhaps this sect brand cannot squeeze into the forefront of the track, but it has its own place, and there must be no big problem.

Is it due to sports health, and is stuck in sports health?

As mentioned earlier, the rise of this wave of smart watches is due to the "independent networking + sports health function."

Previously, industry observer Hong Shibin divided intelligent life into three major scenarios, namely smart homes, connected cars, and smart wearables. Among them, only smart wearable devices centered around users showed a trend of overall demand growth. The main reason behind this is that people are The importance of own health is getting higher and higher.

This point was also reflected during the epidemic.

According to IDC statistics, in the first half of 2020, even with the impact of the new crown pneumonia epidemic, the total global smartwatch shipments still increased by 20% year-on-year, and the total shipments were close to 42 million units, which is only a difference from the annual shipments in 2019 20 million units. Based on the performance in the first half of the year, considering the release of new Apple Watch products in the second half of the year, as well as the attempts to drop prices, it will be easy to surpass the results of 2019.

As for the future trend of smart watches, Jeff Fieldhack, the marketing director of Counterpoint, a market research organization, also stated in the report that after the epidemic, a "national health awareness survey" has been conducted around the world to make people pay attention to health monitoring, sports and fitness and related issues. The demand for equipment has risen sharply, and it is expected that the future development focus of the smart watch market will still be fitness and health applications.

It can be noted that "sports health" has become a key word that smart watches can't do without, and functions such as blood oxygen function are also becoming the "standard" of smart watches.

For manufacturers, if they want to enter this track, the sports health function may be the stepping stone. At the same time, sports health functions have also become a "yoke" for them in the market competition.

According to Counterpoint statistics, in the first half of 2020, Apple won 51.4% of the smartwatch market share with Apple Watch products, which was only 43.2% last year. In addition, in September of this year, Apple even launched a "big killer"-launched Apple Watch SE to test the mid-range market.

Here we can refer to the iPhone SE case. CIRP has issued a report showing that although the iPhone SE was launched late in the second quarter of 2020, its sales accounted for 19% of all iPhone sales, successfully allowing users with old iPhones The upgrade has absorbed many users from the Android camp. It can be said, iPhone SE made a very big success, together with the iPhone 11, make apple fruit to work the tentacles lowered into the mid-market.

This time, Apple will move to the Apple Watch product line based on the iPhone SE's routine-the price is close to the people and the key features are not lacking. Its purpose is self-evident. Therefore, under the premise that Apple Watch is the dominant player and the homogeneity of sports and health functions is too high, as Apple explores more markets, it is more difficult for other smart watch manufacturers to catch up with Apple.

Another question is also reflected here. Is it possible that the highlight of smart watches can only be the "sports health" function? Is there any other path?

In fact, there are still some. After all, with the acceleration of the 5G era, AIoT is becoming a part of the core strategy of various technology companies. As a smart carrier, smart watches can also have an important strategic position in the layout of "AI+IoT". For example, like smart speakers, it has become one of the entrances to smart life.

In fact, there are already some smart watch products that have the function of "control home", but under the light of sports health function, manufacturers have not made any effort to promote this function. The reason behind this may be that the past smart ecology was not very mature, but AIoT has arrived and it is time to promote it.

It can be expected that when smart watches can have more intelligence and control functions, combined with the addition of sports and health functions, it will be able to open more markets, and the interaction with users will be further enhanced.

No comments:

Post a Comment