Maybe you can't think of it. Although inconspicuous in your life, behind the "three meters" of small electric meters, water meters , and gas meters that silently turn for you every day , there is an intelligentization of tens of billions of yuan. revolution!

In January of this year, the Beijing Municipal Water Affairs Bureau stated that it would replace 500,000 smart remote water meters; in August, Jinan Water Affairs Group announced plans to realize automatic meter reading of water meters in the city within 5 years; at the same time, Wuhan Natural Gas Company plans to promote this year Install 60,000 new smart gas meters NB meters...

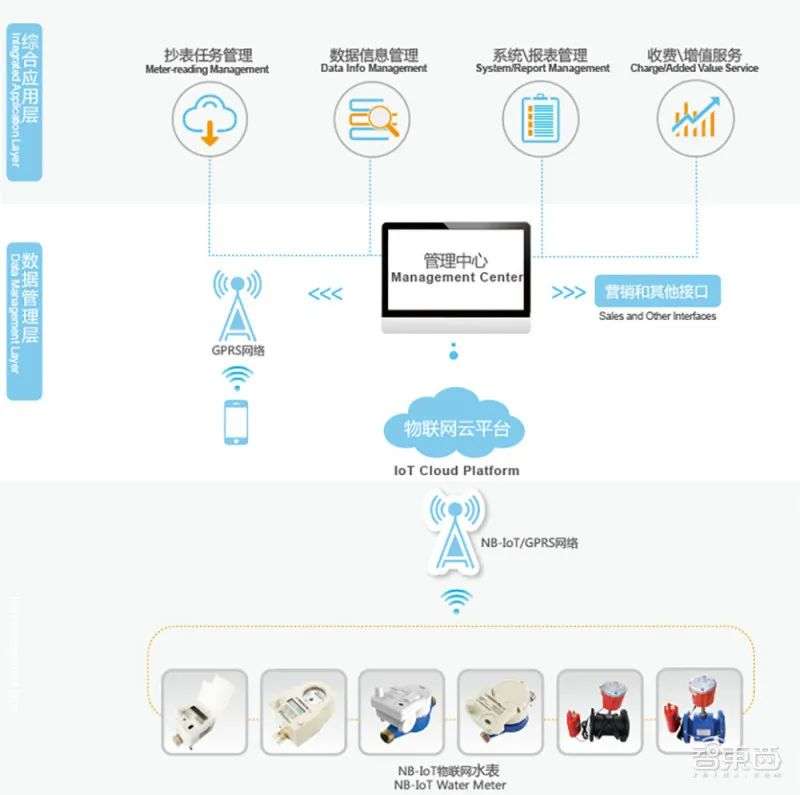

By then, these smart meters can not only uniformly transmit user information and measurement data on the meter side to the concentrator, so that relevant departments can monitor the online operation of each meter in real time, read the meter regularly, and adjust the price, but also facilitate online query and payment by users. and far programmable system valve.

In fact, as early as 2018, these seemingly simple changes in people's livelihood have gradually entered the explosive stage, and a huge market of tens of billions has been born around the industrial chain of various links.

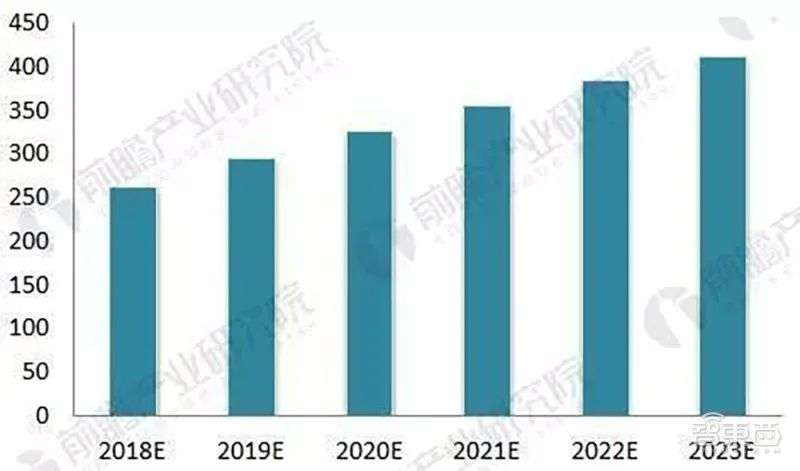

According to the forecast of the Prospective Industry Research Institute, by 2023, the overall market size of smart meters, water meters, and gas meters, which are the most representative in the smart meter industry, is expected to grow from RMB 25 billion in 2018 to more than RMB 40 billion.

▲Foresight Industry Research Institute's forecast of China's smart metering industry market size from 2018 to 2023 (unit: 100 million yuan)

Behind this "40 billion" figure, from upstream suppliers of movement and batteries to midstream watch factories and solution providers, to downstream water supply companies and real estate developers, they have long aimed at this trend and competed. Phase gets a piece of it.

Especially as my country's NB-IoT (Narrowband Internet of Things) applications officially entered the era of blooming flowers in 2019, the number of users exceeded 60 million, and the number of users of my country's NB-IoT water and gas meters has both reached the 10 million mark, marking my country's NB-IoT water meters and gas meters have come to the tens of millions of markets.

How much market development opportunities will this traditional industry of metering create with this rapidly heating up smart metering revolution? Behind the market fire, how many players will benefit from it? What are the differences in their gameplay and advantages?

In order to find these answers, Zhizhi has conducted an in-depth exploration of the smart meter market, and cooperated with Li Jian, senior vice president of Xinyi Information Technology, a new NB-IoT chip startup , and one of the domestic Bitcoin mining giants, AI chip company Jianan Representative industry players such as technology-related persons in charge conduct dialogue and thinking. Through the update process of traditional meters that is now in full swing across the country, we have seen a new battle for smart meters that is fiercely fighting around the industrial chain.

NB-IoT technology revives the smart meter industry fire

In fact, smart metering is not an emerging smart industry.

my country's meter industry has experienced the evolution from mechanical watches to smart watches, and smart watches have also evolved from IC card prepaid meters to smart remote meters, and then to electronic watches. Among them, the birth of the IC card type watch can be traced back to the 1990s, and the IoT smart watch began to appear around 2013.

Why did the IoT smart meters, which appeared as early as 2013, have not been deployed on a large scale nationwide until the last two years?

In addition to the low penetration rate of the smart meter industry, the guidance of national policies, the unification of standards, the supporting of base stations, market demand, and the maturity of AIoT chips, NB-IoT chips and the industry chain are closely related to the vigorous development of smart meters in the Internet of Things.

From a technical point of view, IoT smart meters mainly use 2G, GPRS, Bluetooth, NB-IoT and other transmission technologies to directly transmit meter-end user information and metering data to the background, so that relevant departments can directly adjust water and gas prices in the background. Monitor the operation of each meter in real time, no longer have to go door to door to read the meter, and it is also convenient for residents to directly query and pay online.

In the past two years, the IoT smart watch has exploded, and the mature development of NB-IoT technology and industrial chain is the key to it.

The previous IC card type and small wireless remote transmission type meters have poor signal transmission stability and lack flexibility in remote control of valves and real-time price adjustment. Although IoT smart meters based on 2G and Bluetooth technologies can be To compensate for these disadvantages, there are still shortcomings.

▲IC card prepaid water meter

Li Jian, senior vice president of Xinyi Information Technology, said that on the one hand, the power consumption of 2G networks is relatively large, which cannot meet the low power consumption requirements of low-power wide-area IoT applications; on the other hand, the penetration capability of 2G networks is insufficient. , There are disadvantages such as the inability to cover the underground pipe network, the second floor of the basement and the inside of the container; and Bluetooth, as a short-range communication technology, has limited connections and distances, and cannot be deployed on a large scale in the low-power wide-area IoT.

However, as the three major operators accelerate their bets on the construction of NB-IoT networks, the NB-IoT technology and industry chain with the four major advantages of "low power consumption, wide coverage, large capacity, and low cost" are becoming more and more mature. In comparison, the number of users that the NB-IoT network can carry can be increased by 5 to 10 times.

In addition, in recent years, my country has gradually promoted the frequency removal and withdrawal of 2G/3G networks, which has opened a larger market gap for the application of NB-IoT in the field of smart meters.

Especially in May of this year, the Ministry of Industry and Information Technology of China issued the "Notice on Promoting the Comprehensive Development of Mobile Internet of Things ", proposing to establish a comprehensive mobile Internet of Things ecosystem for the coordinated development of NB-IoT, 4G and 5G.

This notice directly clarifies the technical development direction of smart watches in my country in the future. Within a short period of time, from chip and module suppliers, down to water supply plants and real estate developers, as well as the three major operators connecting the entire industry, they will work harder. Promoting the development, promotion and deployment of the NB-IoT smart watch industry, even many companies that used to do 2G IoT are gradually transforming to 5G and NB-IoT.

In the future, with the widespread application of NB-IoT smart meters, it will also bring greater convenience to smart meters online price adjustment/payment, operation and maintenance costs, network and automation construction, and optimization of resource allocation.

A market with a scale of over RMB 15 billion starts the national smart water-fuel meter reform battle

At present, my country's meter market is still in a situation where traditional mechanical watches and smart watches coexist, and the development levels of the four smart watches of water, electricity, gas and heat are also different.

According to industry-related securities report data, the penetration rate of smart meters in my country today is the highest, exceeding 90%; the second are smart gas meters and smart water meters, with penetration rates of about 50% and 30% respectively; because smart heat meters are mainly concentrated in Heilongjiang, Jilin, etc. There are 15 heating regions in the north, and the seasonality is more obvious, so the penetration rate is the lowest.

Li Jian also told Zhishi that the electricity meter industry is quite special in the Chinese market as a whole. Some traditional electricity meters still use the IC card prepaid model. PLC power line carrier technology is widely used in the power industry and has a more mature and in-depth industry. Chain layout.

"In the current smart meter field in China, some local areas have begun to use smart meter pilots based on NB IoT technology." Li Jian mentioned that allowing the traditional meter industry to overturn the mature business model of the original industrial chain, and from the market in the short term , User needs and local policies, etc., it is still a big challenge.

However, gas meters and water meters are different. These two subdivisions began with Huawei HiSilicon. Operators and some domestic smart meter manufacturers have worked hard for several years. Both in terms of market capacity and market structure, these two subdivisions The market has fully accepted the NB-IoT technology and is gradually developing healthily.

Therefore, at this stage, the development focus of my country's smart meter industry is mainly focused on the smart water meter and smart gas meter market, which is also one of the fastest application scenarios in the development of NB-IoT technology.

In January 2019, the State Administration of Market Supervision and the Ministry of Housing and Urban-Rural Development issued the "Guiding Opinions of the Ministry of Housing and Urban-Rural Development of the State Administration of Market Supervision on Strengthening the Management of the Civilian "Three Meters"", proposing to strengthen the civil "three meters (water meter, electric meter, gas meter) "Management, including the first verification before installation and use, expiry rotation, measurement inaccuracy and other supervision, the entire industry will usher in a golden period of development.

At the same time, since April 1st last year, the country began to implement the "Internet of Things Water Meters" industry standards issued by the Ministry of Housing and Urban-Rural Development. In addition to stipulating the standards for the structure, classification and model of Internet of Things water meters, 2/3 /4G, NB-IoT and eMTC and other cellular mobile communication technologies.

The smart water meter industry standard takes the lead, and smart gas meters will not be absent.

Six months later, the National Standards Committee officially issued the "Internet of Things to Smart Gas Meter Application General Requirements for the Internet of Things System", and held a national standard launch meeting in December, which will further promote the development of the smart gas meter industry, and the standard will also It is the first national standard for IoT technology in the field of smart gas meters.

In the opinion of the relevant person in charge of Canaan Technology, the introduction of the "General Requirements" will also provide an industry standard that can be followed by Canaan Technology and more companies entering the smart gas meter market.

▲Summary of some important relevant policies in my country's smart metering industry since 2017 (Smart East-West Mapping)

Driven by this series of policy winds, governments all over the country are like dominoes, starting a big movement to replace smart water meters and smart gas meters.

Shang Hai meter plan before 2024, the city's more than 600 million households to replace all the gas meter intelligent gas meter; Tianjin is expected within two years will burn millions of traditional water table transformed into NB-IoT IOT table; to Fuzhou Install 300,000 smart remote water meters by the end of 2019; Shenzhen will deploy 580,000 NB-IoT smart water meters by 2020...

How much market has the smart meter industry brought to the replacement of tens of thousands of smart water-fuel meters across the country?

According to the industry report data of Tou Leopard Research Institute, on the one hand, the scale of my country's smart water meter market has reached 5.28 billion yuan as of 2018, and it is expected to maintain a compound annual growth rate of 32% in the next 5 years; on the other hand, the scale of my country's gas meter market It reached RMB 9.8 billion in 2018 and is expected to maintain a compound annual growth rate of 10.7% in the next five years.

Based on this calculation, by 2023, the market size of smart water meters and smart gas meters in my country is expected to reach approximately RMB 21.16 billion and RMB 16.29 billion, respectively, creating a total of 37.45 billion RMB in a smart water-fuel meter market.

In Li Jian's view, although the NB-IoT smart water and gas meter market has not yet fully exploded, its subsequent development space will become larger and larger. Based on relevant industry data, my country’s smart gas meter and smart water meter shipments will both exceed 20 million units this year, which is a direct doubling of shipments that each reached the 10 million mark last year.

In the face of this attractive market cake, the industrial reform battle is about to start.

Players across the industry chain accelerate their bets on the market, and NB-IoT chip manufacturers compete for high ground

Countless players flock to it, but who is the biggest beneficiary in the smart water-fuel meter market?

Smart Things found that in the supply chain, there are chip suppliers such as Unigroup Zhanrui , MediaTek, Jianan Zhizhi and Xinyi Information Technology, which have successively developed low-power, high-performance NB-IoT chips and smart systems; Gold smart, new heavens and technology , Qin Chuan Things such as watchmaker plus speed research development and production of more advanced smart meter terminal products.

At the same time, the three major operators of China Mobile , China Telecom, and China Unicom have also participated, continuously expanding bidding and cooperation, and releasing a series of smart modules and solutions to gradually promote the investigation and update of meters in various places.

In this innovation war surrounding a small smart meter, the competition of smart chips and modules is undoubtedly an important part of it.

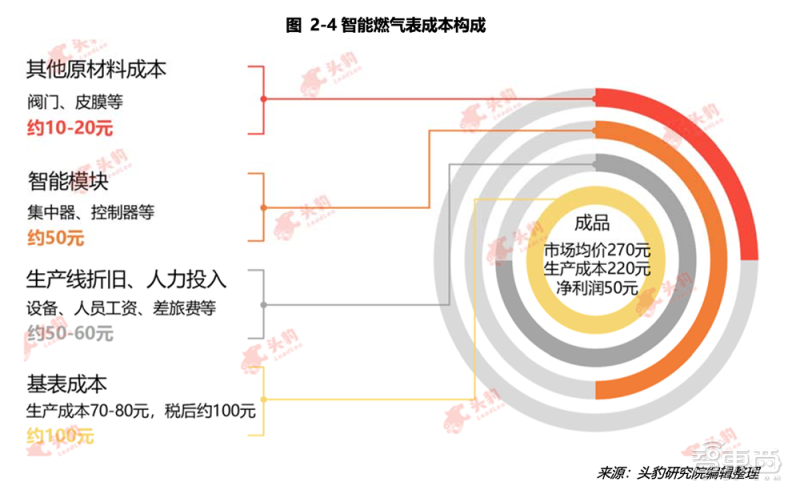

Take the smart gas meter as an example. According to the data of Tou Leopard Research Institute, a smart gas meter with an average market price of 270 yuan has a production cost of about 220 yuan, mainly composed of base meters, smart modules, and raw materials (valves, membranes, etc.). And the four major components of production line depreciation and manpower input.

Among them, in addition to the cost of base meters, manpower and equipment, the cost of smart modules such as concentrators and controllers accounted for the highest proportion, about 50 yuan, accounting for 22.7% of the total cost, and the cost of other raw materials was only about 10-20 yuan. The cost is the lowest.

▲ Cost composition of smart gas meters (Source: Head Leopard Research Institute)

And this market, which accounts for 22.7% of the cost, is a battleground for many chip design manufacturers, attracting new and old players such as Ziguang Zhanrui, Huawei HiSilicon, MediaTek, and Xinyi Information Technology to enter the game and launch various NBs. -IoT chips and solutions come to grab the spot. Zhishi once played in " A chip war triggered by a water meter! In the article " Huawei Qualcomm Charges, Operators Spend Money to Enclose Land ", the NB-IoT chip and industry players and markets are interpreted.

In May last year, the relevant person in charge of the Ningshui Group, a leading smart water meter company in my country, publicly mentioned that the modules used in its NB-IoT IoT water meters contained Huawei HiSilicon chips, and the company signed a contract with Huawei as early as 2015. A strategic cooperation agreement was concluded.

Purple show sharp-based Ivy 8908A chip NB-IoT solutions, have long been landing smart gas meter market in Changsha, Shanghai, Tianjin, Wuhan and other places; MediaTek's MT2625 chip also been high new things together, Shanghai farther away, and other module It is adopted by manufacturers and realized large-scale commercialization in markets such as smart gas meters and smart water meters.

In the past, giants such as Ziguang Zhanrui, HiSilicon, and MediaTek accelerated their deployment, and those who came from behind such as Xinyi Information Technology were not to be outdone.

The smart meter market is one of the key IoT areas of Xinyi Information Technology. At present, the company is mainly expanding in two markets, smart gas meters and smart water meters.

In the first half of this year, Xinyi Information Technology developed a 5G smart remote gas meter based on the self-developed XY1100 NB-loT chip. It successfully passed the test of Golden Card Intelligence, a leading domestic metering company, marking its new generation of NB-IoT platform in gas meters. Official commercial use in the industry.

Li Jian, senior vice president of Xinyi Information Technology, said that smart meters, as a to B industry involving the national economy and the people's livelihood, have very strict requirements on product quality, reliability and stability.

At the same time, the landing of smart meters is also related to the characteristics of different industries and the extent of operator NB-IoT network coverage. Smart gas meters and smart water meters based on Xinyi Information Technology's XY1100 NB-loT chip are still in full swing. At present, the installation, deployment and hanging test of the whole meter have been completed in many cities.

The downstream watch factory team fights fiercely, and the operators are not absent

In addition to fierce competition among upstream chip and module manufacturers, team battles in the downstream watch factory market are also fierce.

In the traditional metering market, China has already had a number of powerful meter leading companies, including Xintian Technology, Ningshui Group, Gold Card Smart, Sanchuan Smart, etc. However, under the impact of the demand for NB-IoT smart meters, these players Also ushered in a new round of competition.

In terms of smart water meters, Ningshui Group is continuously adjusting and upgrading its existing production layout and introducing automated equipment to tap production capacity. Its "4.05 million smart water meter expansion project per year" started in April this year and is expected to It will be officially put into production in December 2022.

As smart water meters gradually become the main driving force of Ningshui Group's revenue growth, Ningshui Group's performance in the first half of this year also ushered in a small explosion. According to the 2020 mid-year report of Ningshui Group, its revenue in the first half of the year was 656 million yuan, an increase of 18.33% year-on-year, and its net profit was 117 million yuan, an increase of 46.51% year-on-year.

In terms of smart gas meters, in 2019, Gold Card Smart has deployed more than 10 million IoT smart terminals, including nearly 5 million NB-IoT smart terminals, and more than 6 million smart terminals connected to the IoT platform.

In April this year, the person in charge of Gold Card Intelligence publicly mentioned that its market share in the NB-IoT smart gas meter market is estimated to have reached 30% to 50%.

On the other hand, Xintian Technology, which is also a leading company in smart meters, has a layout in smart water meters, smart gas meters, smart heat meters and other markets. Among them, in 2019, Xintian Technology's civilian smart water meter and industrial and commercial smart flowmeter revenue totaled approximately 718 million yuan.

As the automation rate of Xintian Technology's Industry 4.0 smart factory has increased to 60%, its smart meter production capacity has reached 4 million sets.

The relevant person in charge of Xintian Technology said that thanks to the promotion of smart meter industry policies, technological improvements and market demand, in the first half of 2020, Xintian Technology's NB-IoT smart water meter orders have achieved a substantial increase, an increase of more than 50% year-on-year .

At the same time, more than 80% of Xintian Technology's bidding this year are NB smart meter bidding projects, and the bidding amount for a single project is also larger than in previous years.

▲Structure diagram of Xintian Technology's NB-IoT IoT water meter system

At the same time, this wave of opportunities in the NB-IoT smart metering market has also brought a new atmosphere to my country’s science and technology innovation board. Qinchuan IOT, which just passed the meeting in April this year, is a company in the Internet of Things smart gas and smart water. A smart meter company with profound accumulation.

In addition to chip and watch manufacturers, there are three major operators throughout the smart meter industry chain.

Since 2016, China Mobile, China Telecom, and China Unicom have been increasing the layout of NB-IoT network construction and promoting the development of the smart meter industry.

Take China Mobile as an example. In 2017, China Mobile launched smart meter solutions. However, in recent years, its layout center has gradually moved closer to smart water meters and smart gas meters, and has cooperated with local governments and water and gas companies to jointly promote the deployment and implementation of smart water meters.

In December last year, China Mobile IOT signed a three-year procurement agreement with China Combustion Material Supply Chain Co., Ltd., involving 6 million sets of NB smart gas end-to-end solutions.

In September of this year, China Mobile also formally signed a strategic cooperation with China Gas Holdings Co., Ltd., and will continue to deepen the comprehensive cooperation between the two parties in the NB IoT watch business.

In addition, China Unicom and China Telecom have also deployed a wide range of smart water meters and smart gas meters.

In general, this top-down competition that set off a wave of innovation in the smart meter industry not only provides new opportunities for traditional players to transform in the new era, but also opens up greater opportunities for new players to enter the game. Market development space.

Is NB-IoT intelligence the only way out? The development difficulties behind the huge market business

However, is the NB-IoT intelligence of smart meters the only way out for the industry? the answer is negative.

There is not only one model for the development of the smart metering industry. Especially at different stages of the industry, the influx and penetration of NB-IoT technology also provides opportunities for some players to use their own technological advantages to compete for differentiation. For example, Canaan Technology, one of the top three domestic bitcoin mining machines.

Unlike Ziguang Zhanrui, MediaTek, Xinyi Information Technology and other companies, Canaan Technology does not use NB-IoT chips as the entry point for the smart meter market, but relies on AI chips.

The relevant person in charge of Canaan Technology told Zhizhi that there are currently two main directions for its smart meter reading business. One is the smart upgrade of water, electricity and gas meters, and the other is smart factory production and measurement scenarios.化. At the same time, Canaan Technology has also established a data analysis platform at the back end to provide data analysis services.

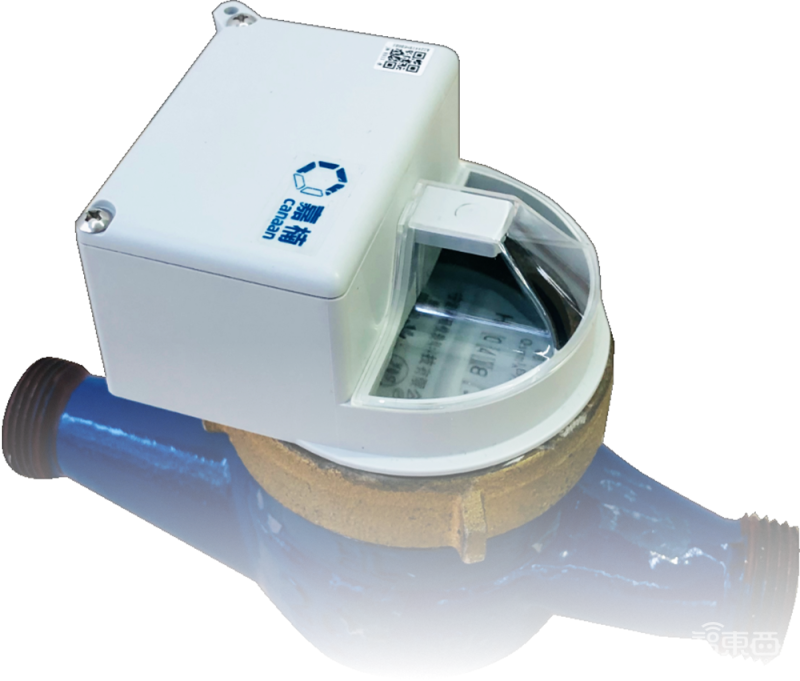

In response to the problems of high cost, low efficiency, and difficulty in entering the home in the traditional meter reading mode, Canaan Technology has launched an intelligent meter reading system. Its module is equipped with a self-developed AI chip K210 and a micro camera, and supports GPRS and 3G. /4G, NB-IoT and Bluetooth network connection.

It is understood that the system can take pictures, identify, store, and automatically upload the meter within the monitoring period set by the user, with a recognition accuracy of 99.6%, which not only saves the labor cost of manual meter reading, but also There is no need to replace and rebuild old tables, which further improves the utilization rate of old tables.

At this stage, Canaan Technology's smart meter reading has been implemented in the largest shantytown renovation area in China-Guiyang Huaguoyuan Community, and the deployment of smart meters has reached a scale of 10,000.

The rise of the smart metering market based on NB-IoT technology has not only brought a lot of development opportunities to the industry, it will also bring about changes in the industry.

In the opinion of the relevant person in charge of Canaan Technology, the rise of this market is for chip design companies to try to increase the product stickiness between their own chips and users, otherwise the traditional direct sales of chips will be lack of stickiness and replaceable. Sexual issues, for example, the chips in different generations of Xiaomi boxes use different brands.

Therefore, they believe that integrating the chip with the algorithm and software environment into a minimum functional unit (module or module) is more competitive in the market.

"We found that, with the exception of a few companies, most of the companies that make products have limited AI development capabilities, and they have greater demand for functional modules." The relevant person in charge of Canaan Technology said that the company will provide system integrators OEM with partners to directly provide final products and some back-end SaaS services, such as face recognition panel machines and smart energy efficiency OEM products.

At the same time, the relevant person in charge of Canaan Technology believes that with the maturity of machine learning technologies such as image recognition, it will further promote the intelligentization of meters and lay the foundation for the machine learning revolution of smart meters.

During the NB-IoT smart metering landing, the industry still faces provisional ranking civil reconstruction funds, local policy differences, standardization and other issues, and this is an ongoing process of development spiral upward.

According to Li Jian, senior vice president of Xinyi Information Technology, the NB-IoT smart metering market is different from the new ETC market. The former market is relatively mature, competition is relatively sufficient, and market demand is relatively clear.

But Li Jian believes that there are two difficulties in the implementation of NB-IoT smart meters.

The first is the problem of NB-IoT network coverage. Domestic operators have not yet completed the construction of NB-IoT networks as well as 2G networks, and they still need continuous investment from operators; second, the reliability and stability of products also require relevant industry Companies continue to spend time polishing and upgrading.

"The entire metering market, from chip vendors to solution providers, from module vendors, major meter manufacturers to gas companies, water companies, etc., each link needs to work together to innovate, so as to promote the entire market and industry. The healthy and healthy development of the chain." Li Jian said.

Concluding remarks: the smart market segmentation competition set off by the new lifestyle

It may be hard to think that a water meter and gas meter that are not conspicuous in people's lives can also set off a huge wave of smart implementation. With the support of technology and policy, the smart meter industry has entered the fast track of development. What follows will be the release of huge market space and increasingly fierce market competition.

But in the final analysis, the biggest beneficiaries of this industry's rise are not chip and module manufacturers, nor watchmakers or operators, but the users themselves.

As part of the construction of a new infrastructure smart city, the value of NB-IoT technology brought to people in the smart metering market is gradually landing and developing, far more than the economic benefits produced by millions of chips and hundreds of smart meters. Much.

In the future, with the further development and implementation of the smart metering industry, it is believed that people will definitely be able to enjoy the convenience of more technological advancements in life and work.

No comments:

Post a Comment