DJI hopes to become an artificial intelligence company.

1. Unmanned aerial vehicles are essentially a niche market that cannot be truly "popularized", and DJI is "seeking defeat alone";

2. DJI needs to find another large enough area with room for imagination to support a valuation of 166 billion yuan;

3. In the field of autonomous driving, DJI is very likely to follow Huawei's route in the field of smart cars and provide related solutions for other manufacturers with its technological advantages.

Since 2020, rumors about DJI layoffs have never stopped.

After flying for more than ten years, the drone giant seems to have come to the corner of the alley. According to sources in the drone industry chain, the demand for consumer drones has declined this year, and overcapacity and large inventory are the main reasons for DJI's layoffs.

According to a Reuters report in August, the sales and marketing department is the "hit area", and founder Wang Tao asked to cut marketing and sales staff by two-thirds.

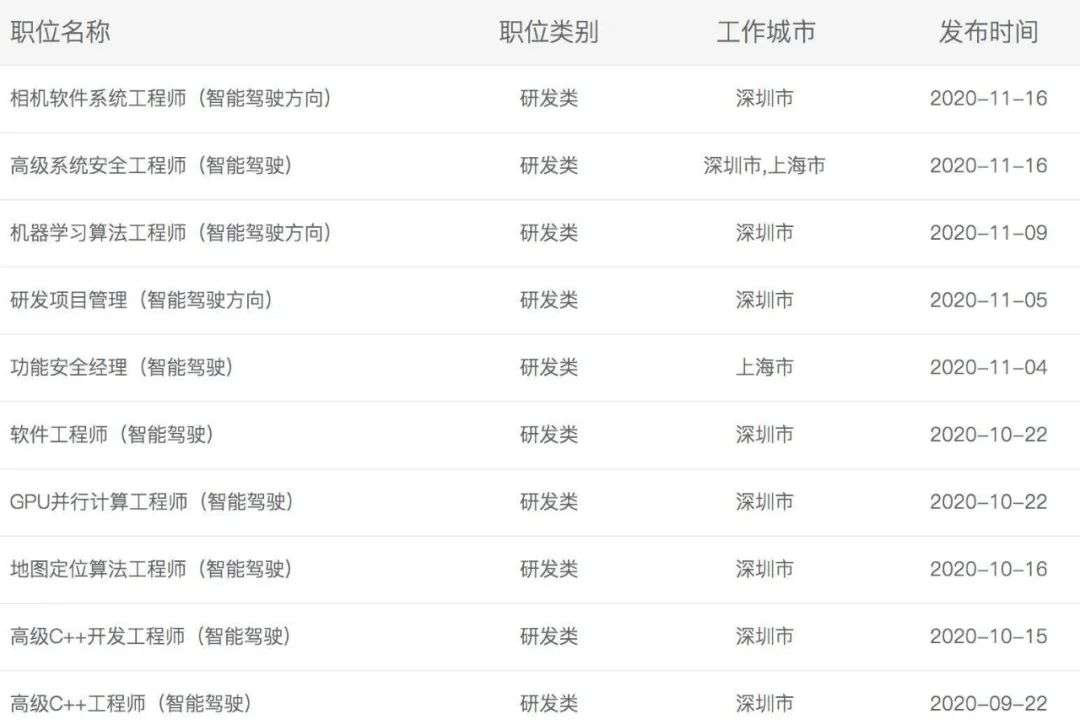

In contrast to layoffs, DJI is vigorously recruiting people related to autonomous driving.

Source: DJI official website

The official website shows that DJI is currently recruiting hardware engineers in automotive electronics, software engineers in the direction of intelligent driving, and even expanding to professionals in system security. The work location is not limited to Shenzhen, Shanghai is also within the scope of recruitment.

“In terms of autonomous driving, DJI has always had recruitment needs.” An auto industry headhunter told Yiou, “The demand for algorithms is the greatest.” Throw an olive branch.

Since 2015, the news of DJI's development of autonomous driving has been circulating in the industry, and some investors even said that DJI will invest 30% of its research and development in this field in the future. In this regard, DJI has repeatedly denied that, Xie Tiandi, the director of public relations, once came forward to clarify: "The company has not preset commercial goals in terms of autonomous driving."

However, during CES in early 2020, DJI's internally incubated subsidiary Livox (Lanwo Technology), with its two low-priced lidar products, Horizon (Horizon) and Tele-15 (Long-range 15), opened the mystery of DJI's autonomous driving. A corner. After that, DJI's official caliber of denial of autonomous driving seemed to be slightly lax.

Today's large-scale recruitment is more like an important signal for DJI to accelerate its pace in this field. According to industry insiders, DJI divides the autonomous driving department according to the L3/L4 standard, and may announce the latest development of autonomous driving in the near future.

DJI is already a drone giant, why should it enter a new field? Is it going to tell a similar story?

Flying to the "top" drone market

Looking at the global drone market, if DJI claims to be number two, no one would dare to be number one. Even the Wall Street Journal, which rarely praises Chinese technology companies, has taken the initiative to label DJI as "the first Chinese company to become a pioneer in the world's major technology consumer products."

14 years after its establishment, DJI now controls more than 80% of the global consumer drone market, with a valuation of more than 166 billion yuan, ranking seventh in the "2020 China Unicorn List TOP100" and is the only one. Chinese technology giants that monopolize the global market.

The industry usually compares DJI to Apple. But in the eyes of industry insiders, there is no rival like "Samsung" in the field of consumer drones. This time led the United States to initiate infringement lawsuits against it, accusing DJI of violating Article 337 of the "Tariff Act of 1930" that prohibits unfair competition or trade practices.

Although exempted from the ban after two years of investigation, DJI, as the leader, still cannot sit back and relax.

"DJI's success lies in the creation of the unprofessional unmanned aerial vehicle (UAV) market." Frost & Sullivan analyst Michael Blaze once concluded. But the problem is that DJI is too focused on this market and has no competitors.

Today, drones are still a niche market. On the consumer side, only a small number of people have the opportunity to become large users of drones. DJI is attracting more players by continuously reducing unit prices, while competing with friends. In the field of consumer drones, demand growth brought about by consumption upgrades is not obvious, and the instability of the flight restriction policy has exacerbated the uncertainty of the market.

"The consumer drone market is so big, and DJI is already the king. From a commercial point of view, few giant manufacturers will challenge it in this field." Some insiders pointed out.

DJI is indeed seeking defeat alone, which has also become an obstacle to the popularization of drones. "Only when the real competitors of DJI appear, drones can go out of the niche market and go to the masses." Xie Tiandi once said.

According to IDC's forecast in 2018, the global market for consumer and corporate drones is USD 9 billion, and the average annual growth rate for the next 5 years is expected to be about 30%. According to this calculation, the overall size of the drone market in 2020 is approximately US$15.21 billion. According to Gartner's forecast, this figure drops to 11.2 billion U.S. dollars, of which at least 50% of the scale belongs to industry-grade drones. This means that the market for consumer drones has been further compressed.

Wang Tao seemed to have a hunch. In an interview in 2016, he stated that the drone market is about to be saturated, and DJI's revenue will reach its peak at 20 billion yuan.

Today, DJI's revenue has already exceeded 20 billion yuan, but this revenue is obviously unable to support its 166 billion yuan valuation.

"Emerging industries" surfaced

DJI is seeking new breakthroughs, and it first sets its sights on industry applications.

Second half of 2015, Dajiang into the legislature, business applications department, industry-oriented enterprises to provide professional solutions. At present, DJI has launched corresponding products in the fields of public security, energy, construction, infrastructure, surveying and mapping, power, oil and gas. The Prospective Industry Research Institute predicts that the industry scale of industrial drones will be about 45 billion yuan in 2025, with an average growth rate of about 30%.

But after all, industrial drones are different from consumer drones. In addition to technology, prices and sales systems are the focus of DJI's need to re-pull.

In addition, Dajiang also actively explore the field of imaging systems equipment, ground equipment release hand holding cloud camera spiritual eye, the camera platform Zen and so on.

But strictly speaking, both industrial drones and imaging system equipment are still in the scope of drones. In essence, DJI is still that DJI, and has not stepped out of its comfort zone. DJI needs to find a new area that is large enough and has enough room for imagination as a new growth point for its revenue and valuation.

DJI once mentioned the ideal future revenue structure in a financing material sent to investment institutions: 50% are drones, 25% are from the imaging sector, and 25% are from new businesses.

What is the new business? DJI clearly mentioned the medical imaging AI market and the education market, and at the same time vaguely stated that there are also artificial intelligence "emerging industries" centered on vision, algorithms, image processing, and integrated chip technology. In 2019, DJI has launched the first educational robot mecha master RoboMaster S1 to test the field of robot education.

But some people in the industry think this is DJI's "obscure approach": "DJI will not announce what it wants to do. The direction announced to the outside world is likely to mislead competitors."

Since its development, DJI has not caused much splash in the medical imaging AI market and education market, which may confirm the conjectures of the above-mentioned people. At the same time, the mysterious "emerging industries" that DJI has avoided talking about seem to gradually surface.

During CES in early 2020, DJI's internally incubated subsidiary Livox (Lanwo Technology) released two lidar products, Horizon (Horizon) and Tele-15 (Long-distance 15), which provide services for L3/L4 autonomous vehicles. These two rotating mirror lidars have attracted the attention of the industry with "non-mainstream" technical routes and low prices below 10,000 yuan.

There is very little public information about Livox. It is said that the original intention of Livox was that DJI hopes to carry self-developed lidar on industrial drones, but the team found that the autonomous driving industry is a broader market during the research and development process, and Livox's research line has also become vehicle lidar. .

DJI has always been a company that "does not want to say more".

Since 2015, the industry has continued to report about DJI’s entry into the autonomous driving field, which DJI has repeatedly denied. Until 2020, Livox officially launched two products, the rumors can be regarded as a real hammer. In fact, Livox was founded in 2016, and has been steadily "doing" it for 4 years when it made its public debut.

According to industry insiders, with low prices, Livox's products have now gained part of the market share.

What is the imagination of autonomous driving?

Since the beginning of this year, DJI has gradually "relaxed" on autonomous driving. When receiving inquiries about the automotive field, DJI reversed its previous veto attitude and responded: "The exploration of applying technology to the automotive field has made some progress."

Recently, a large number of recruitment information updated by DJI on major websites have added a reliable basis to the rumors of its research and development of autonomous driving technology.

According to Yiou's understanding, similar to Baidu 's IDG (Intelligent Driving Business Group), DJI internally divides autonomous driving into mass-production autonomous driving and forward-looking autonomous driving. The former focuses on the research and development of L3 autonomous driving technology. , The direction of the latter is L4. It is not yet clear whether there are also intelligent transportation related businesses.

Perhaps even earlier, DJI began preparations to build an autonomous driving business team.

In 2015, its Silicon Valley R&D center introduced former Tesla engineer Darren Liccardo as the vice president of global engineering. According to LinkedIn information, Dai Lun established an ADAS engineering team during his tenure at Tesla and also served as the head of the autonomous driving technology research and development team at BMW.

After Darren left in 2017, DJI fell into silence in autonomous driving. It was only recently that it found clues in its recruitment information and Livox's actions.

For DJI, autonomous driving is naturally more imaginative than the drone market. According to estimates by Soochow Securities, the size of the autonomous driving market will be 84.4 billion yuan in 2020, and it will reach 225 billion yuan in 2025. This figure is only for the domestic ADAS market, not to mention the broader L4 autonomous driving field where the "money" scene is broader.

In the past two years, the development of autonomous driving in China has indeed experienced a low point. However, since the beginning of this year, companies such as Xiaoma Zhixing , Uisee Technology , and Tage Zhixing have obtained new financing and new progress in commercialization, which proves that autonomous driving is still an area worthy of long-term investment.

The reason why autonomous driving has been underappreciated is largely due to its commercialization problems. This is precisely the part that DJI "don't care about". Some DJI executives described it like this: "DJI is like a huge laboratory. Product development is linked by technology research and development, and commercial projects are less than 1/3 of the laboratory."

This technology-first spirit is inherited from founder Wang Tao. In the early days of entrepreneurship, he did not think too much about the business model, but he kept improving the details of the product.

DJI has a strong internal engineer culture. In its R&D logic, the direction of commercialization has never been the first consideration. The R&D team believes that it is impossible to do R&D after pre-setting the commercialization direction.

Luo Zhenhua, the president of DJI, once pointed out the company's operational thinking-when developing products, DJI first seeks technological breakthroughs. Once this stage is reached, clear market needs will emerge.

Another Huawei?

Technically speaking, the perception part is still the most difficult problem for autonomous driving today. In the past, DJI has accumulated rich experience in visual recognition.

When Phantom 4 was released in 2016, Wang Tao pointed out its essence with a sentence "Welcome to the era of computer vision". At the same time, DJI changed its description from "Flying Camera" to "Flying Robot", further demonstrating artificial intelligence ambitions. Then the "Royal" Mavic Pro released by it was the first time that deep learning technology was applied to drones to strengthen intelligent functions.

"DJI has a technical foundation." Some insiders analyzed, "Although the application scenario can be migrated from drones to unmanned driving, it is also very difficult. If you want to do a good job, it is no less than developing a new one. 'Elf' products."

According to the website of the State Intellectual Property Office, DJI has also obtained patents related to autonomous vehicles while applying for patents related to drones. Such as control methods, control devices and vehicles for automatic driving; determination of installation parameters of on-board imaging devices and driving control methods and equipment.

Source: State Intellectual Property Office website

In the field of autonomous driving, DJI also has "rely on". Li Zexiang, director of DJI, led the founding of the autonomous driving company Xidi Zhijia in 2017 . The company completed the A++ round of financing of over 100 million yuan led by Liangjiang Fund this year, and is accelerating the implementation of new autonomous driving fund business.

Li Zexiang is a professor at the Hong Kong University of Science and Technology and Wang Tao's mentor. Because of his early investment and dedication to DJI, he was called the "Incubator" of DJI by the outside world. After DJI enters the field of autonomous driving, in what ways will Li Zexiang help the student Wang Tao again, which is also an "Easter egg" left to the outside world.

There is very little public information about DJI's autonomous driving. Yiou guessed that in the field of autonomous driving, DJI is likely to try to follow Huawei's route in the automotive industry-not building cars, but empowering OEMs through a variety of smart car solutions.

At the end of October, Huawei released the smart car solution brand "HI", which includes a computing and communication architecture, smart cockpit, smart driving, smart networking, smart car cloud services, smart electric five communication systems, as well as millimeter wave radar and laser More than 30 intelligent components such as radar and camera.

"HI" is built on the advantages of Huawei's ICT technology, and DJI's pursuit of technology is also the consensus of the industry.

Throughout the history of DJI's product development, it generally starts from the subsystems and then gradually develops to the finished system. The same is true from flight control systems to aerial drones, from suspended gimbals to handheld gimbals. According to the existing lidar products, DJI is bound to introduce more system products and technology-related solutions in the future.

Because of the high-paying and high-pressure corporate culture, some people call DJI the "Little Huawei". In the automotive field, DJI may also become "another Huawei."

Conclusion

In the past, DJI created the consumer drone market on its own. The persistent pursuit of technology has allowed it to accumulate more than 5,000 patent information, thus having absolute technical barriers and the right to speak. Almost any company that wants to make drones must obtain a patent license from DJI.

But Wang Tao did not limit DJI to the field of drones. From its exploration in multiple fields, it can be seen that DJI hopes to become an artificial intelligence company.

Autonomous driving is an in-depth exploration in this field. If it succeeds, DJI's valuation is bound to take another step.

No comments:

Post a Comment