In the crypto market, Tether's position has always been delicate.

On the one hand, as the earliest stable currency, Tether emerged after the "coin circle 94" as an effective pricing tool and safe-haven asset; on the other hand, due to its own compliance issues and the opacity of reserve assets, Tether broke out many times Crisis of trust and fall into a regulatory quagmire

Especially this year, with the overall recovery of the encryption market, Tether started the "money printing mode". In just the past 9 months, it has issued more than 10 billion U.S. dollars.

Behind the crazy growth, is it demand-driven or inflated assets? Paolo Ardoino, CTO of Bitfinex & Tether, accepted an exclusive interview with Odaily Planet Daily to respond to related questions.

Paolo Ardoino said that behind Tether is 100% of asset reserves; this year's continuous issuance, in the final analysis, the market is driving the demand for Tether. In addition, from the perspective of fund transfer trends, the demand for Tether in East Asia seems to be particularly strong.

The following is a record of Q&A, compiled by Odaily Planet Daily:

Odaily: From Realcoin in 2014 to USDT in 2017, Tether has experienced 6 years of ups and downs. First of all, please give you a detailed introduction to the process of Tether issuance and redemption of USDT?

Paolo Ardoino: Tether Token (USDT) is a digital token built on various blockchain chains, including Omni, Ethereum, EOS, Tron, Algorand, Bitcoin Cash's Simple Ledger Protocol (SLP) and Liquid Network. These agreements consist of open source software linked to the block, allowing the issuance and redemption of USDT.

Tether will issue tokens based on market demand and put them into the market for trading. According to Tether's terms of service, USDT can be exchanged and traded at a ratio of 1 USDT: 1 USD.

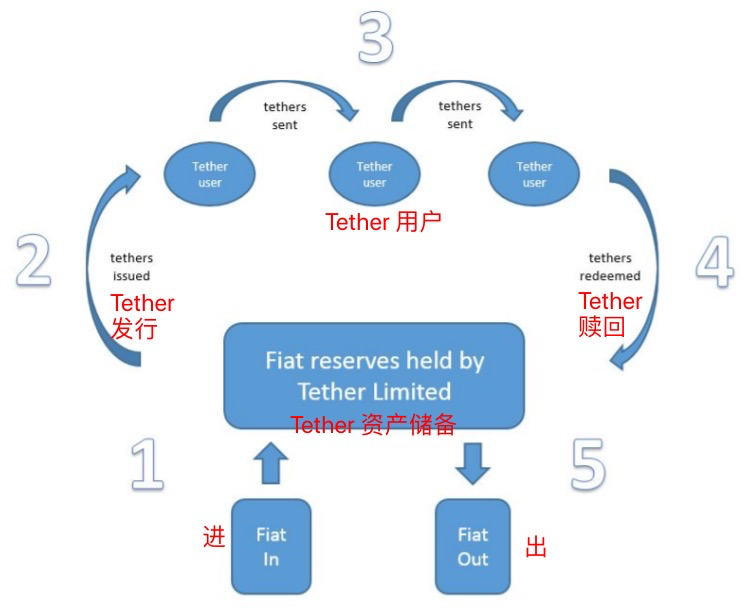

At the time of issuance, USDT will be backed by 100% of Tether's assets; when the customer redeems, USDT will be returned to Tether and the user's reserve fund will be refunded. As follows:

Paolo Ardoino: Tether tokens play a key role in the transaction of cryptocurrency and play a vital role. In fact, in recent years, we have seen a shift: from using Bitcoin transactions as the main valuation to using Tether as the main valuation. In addition, USDT is increasingly being used for innovative projects in the field of remittance and digital assets, including decentralized finance (DeFi). In general, it is the market that drives the demand for Tether.

Odaily: From the perspective of time distribution, March, April, July and August are the months with the fastest growth of USDT. Why does the amount of additional issuance fluctuate greatly over time? Many people have tried to summarize the relationship between the additional USDT issuance and the trend of the "big market" currency price. What do we think?

Paolo Ardoino: People are looking for efficient, mobile, and reliable alternatives to replace outdated banks and payment systems, and investors also want a safe haven to reduce risks. In an era full of challenges and uncertainties, the practicality, security and feasibility of digital currencies such as Tether have been at the forefront and become the focus of the market.

As the largest, most liquid, and most technologically innovative stablecoin, Tether is a model of how the global market can use blockchain technology to operate more efficiently, as well as a representative of payment channels built for future business and innovative development.

Odaily: Is this year's additional issuance mainly from individual users or institutional users? What is the maximum amount of single additional issuance? What are the changes in the number of users in different regions?

Paolo Ardoino: The growing demand for USDT reflects the development of the entire crypto ecosystem.

People trust USDT, and they also like to use the most liquid, stable and outstanding stable currency among the cryptocurrencies. This is best demonstrated in East Asia. According to Chainalysis data, USDT token is the largest and most popular stable currency in East Asia.

Odaily: In the past few years, we have also seen that USDT cross-chain demand has become stronger and stronger. From the previous Omni, ETH, Tron to EOS, Algorand, OMG and Solana, there may be more public chains to undertake USDT in the future. Demand. What are the technical difficulties when different public chains undertake USDT conversion requirements? What difficulties did Tether encounter when switching chains, and how did they solve them? (Can give examples)

Paolo Ardoino: When we receive a chain swap request from a crypto exchange, we need to coordinate and manage the entire chain swap process with the exchange until it is completed.

In some cases, when our client's request for chain swap funds exceeds the number of USDT tokens held in our inventory wallet on the target blockchain. If we want to continue the chain exchange, then we must authorize additional USDT issuance and transfer these tokens to the target blockchain.

After the transfer is completed, we either burn the same amount of USDT tokens on the initial blockchain (USDT on the target chain will be fully supported and issued), or keep these tokens in the treasury wallet on the initial blockchain Medium (unsecured), used for future chain exchanges with customers.

Odaily: At present, ERC20-USDT has the largest issuance, and TRC-20 has the lowest and fastest handling fee, and is very much loved. In your opinion, can the ERC20 and TRC20 versions of USDT maintain the first-mover advantage? Can other versions of USDT change the current situation?

Paolo Ardoino: Tether likes and is willing to support many blockchain innovations. For other blockchain versions of USDT tokens to develop, more projects must be encouraged to adopt and use them.

Odaily: Although there are other different versions of USDT (such as EOS version of USDT), they are not supported by centralized exchanges. For latecomers, what is the necessity and advantage of existence?

Paolo Ardoino: USDT allows exchanges to easily use fiat currencies on the blockchain. The exchange supports different versions of USDT tokens and will be able to better serve various blockchain communities.

Odaily: In addition to USDT, Tether has also issued stablecoins anchored to the euro, offshore renminbi and gold, but the development status is not good compared with USDT, only tens of millions. What are the obstacles? How to expand this part of the market?

Paolo Ardoino: USDT is currently more popular than other Tether tokens supported by fiat currencies. This is mainly because USDT is linked to the global legal reserve currency, the US dollar. The dominance of the US dollar determines the popularity of USDT. In addition, time will tell whether the market will have more demand for Tether's non-USDT products; if so, Tether is also ready.

Odaily: In the future, what other plans does Tether have? Will it issue stablecoins based on more legal currencies and physical objects?

Paolo Ardoino: Of course, we are still willing to explore other contents of the Tether product portfolio.

Odaily: In addition to Tether, there have also been many stable coins in the crypto market in the past two years, such as USDC, PAX, GUSD, etc. Do you think the emergence of these stablecoins will impact Tether's current status?

Paolo Ardoino: While Tether issuance continues to break records (remains ahead), but we also welcomed happy to see the whole stable currency markets are booming. We are grateful for users to choose Tether in the free market. But a single tree is difficult to support, and a lone tree cannot become a forest. It is difficult for a company to win alone, and it is possible for multiple companies or enterprises to form a joint force to achieve success.

Nice post!

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteI found the interview with Bitfinex CTO Paolo Ardoino to be an insightful read, shedding light on the challenges and innovations in the cryptocurrency space. If you're intrigued by the role of a CTO and want to explore finding one for your startup, the resource at https://www.cleveroad.com/blog/how-to-find-cto-for-startup/ provides valuable advice and strategies to help you in your search. It's a great complement to the expertise shared by Paolo in the interview.

ReplyDelete