Bitcoin broke through a two-year high and closed up 28% on a monthly basis;

New addresses increased by 89%, active addresses decreased by 20%;

The Wall Street Journal reported that MicroStrategy invested in Bitcoin;

At the beginning of the rainy season, Bitcoin's entire network computing power dropped by 23% to join the relocation;

Data: The number of Bitcoin whale addresses hit a new high since the fall of 2016;

Report: BTC rose to 14,000 US dollars, but the relevant indicators have not fully followed up.

Secondary market

Bitcoin breaks through a 2-year high, closes up 28% monthly

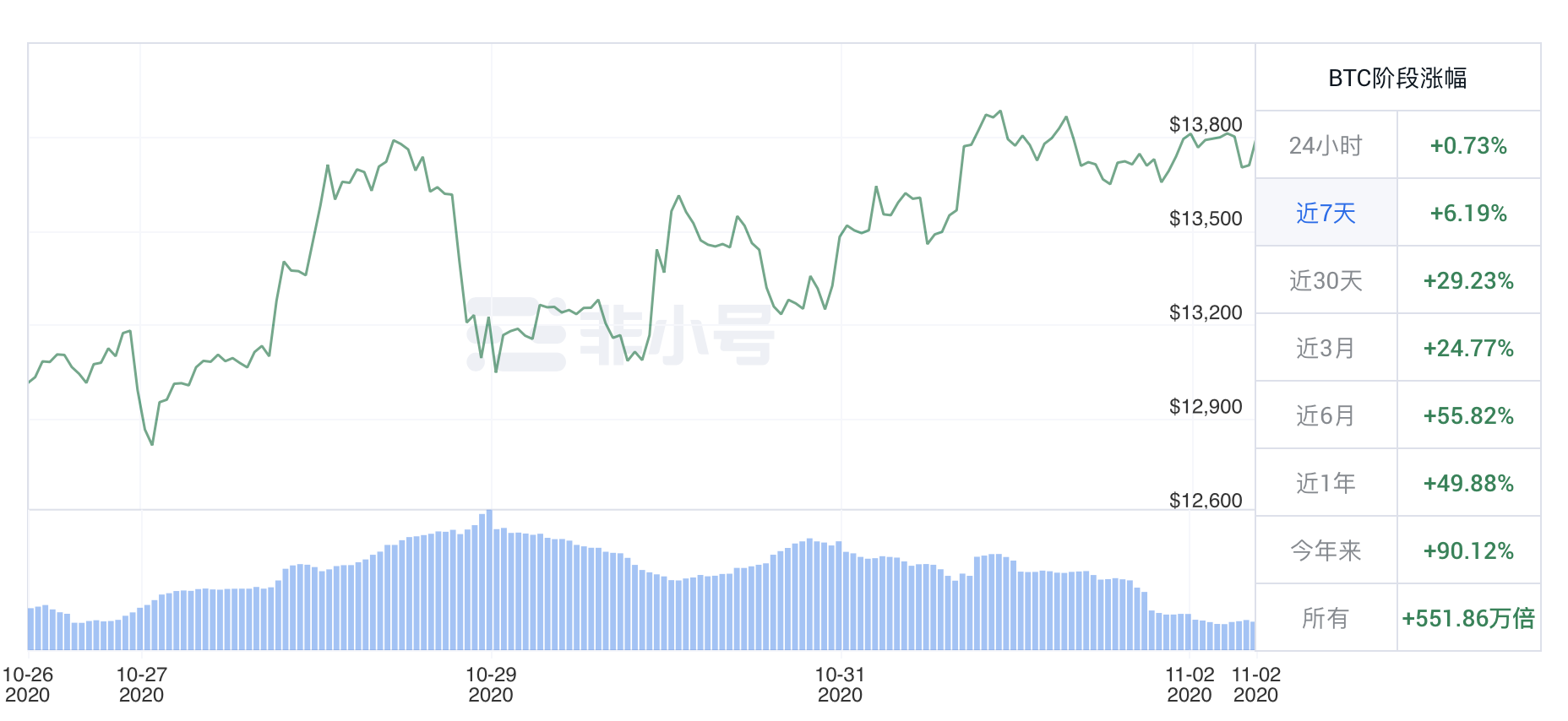

This week, Bitcoin climbed up the ranks, testing the $13,000 and $14,000 mark successively. On October 31, it rose 3.5%, and Bitcoin rushed to a new high of $14,099 after falling in 2018. It has now fallen back to around 13800USDT. Weekly closed up 6%, monthly closed up 28%.

Bitcoin has a net inflow of $490 million this week

U.S. dollar to bitcoin transactions accounted for 7% drop

In this week’s bitcoin-to-fiat currency transactions, the US dollar ranked first, accounting for 72.4% of the total, a 7% decrease from last week. At the same time, the proportion of the yen rose by 4 points to 24.6%. The total share of the remaining legal currencies against Bitcoin rose slightly to 7.3%.

Data on the chain

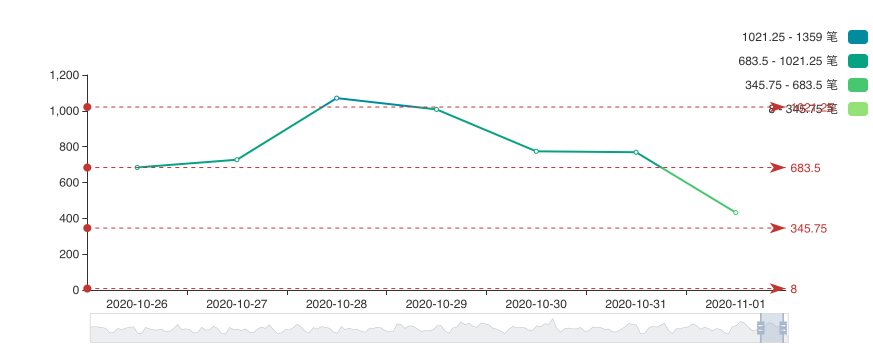

Large transfers declined slightly

In terms of large-value transfers, a total of 5,465 transactions of ≥100 BTC occurred in large-value transfers this week, a slight decrease from last week.

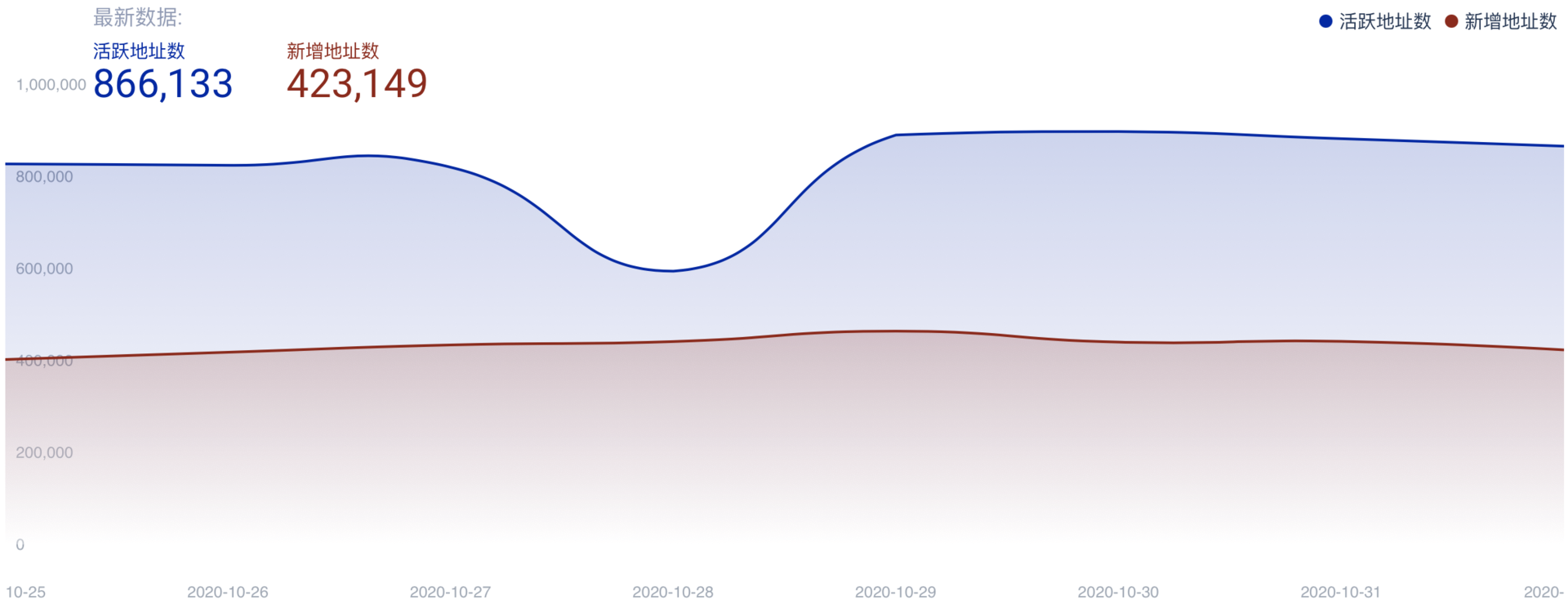

New addresses increased by 89%, active addresses decreased by 20%

As of November 1, the number of new Bitcoin addresses was 420,000+, an increase of 89% compared to last Sunday; the weekly high of active addresses was 890,000+ and the low was 590,000+, compared to last week A drop of nearly 20%.

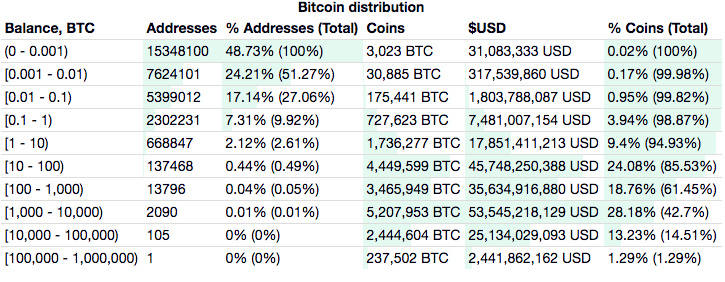

The number of small coin holding addresses has decreased slightly

Among the Bitcoin addresses, 48.73% of the addresses accounted for 0.02% of the total currency volume, a slight increase from last week; 24.21% of the addresses accounted for 0.17% of the total currency volume, a slight decrease from last week.

Mining

At the beginning of the rainy season, the hash rate of Bitcoin's entire network dropped by 23%.

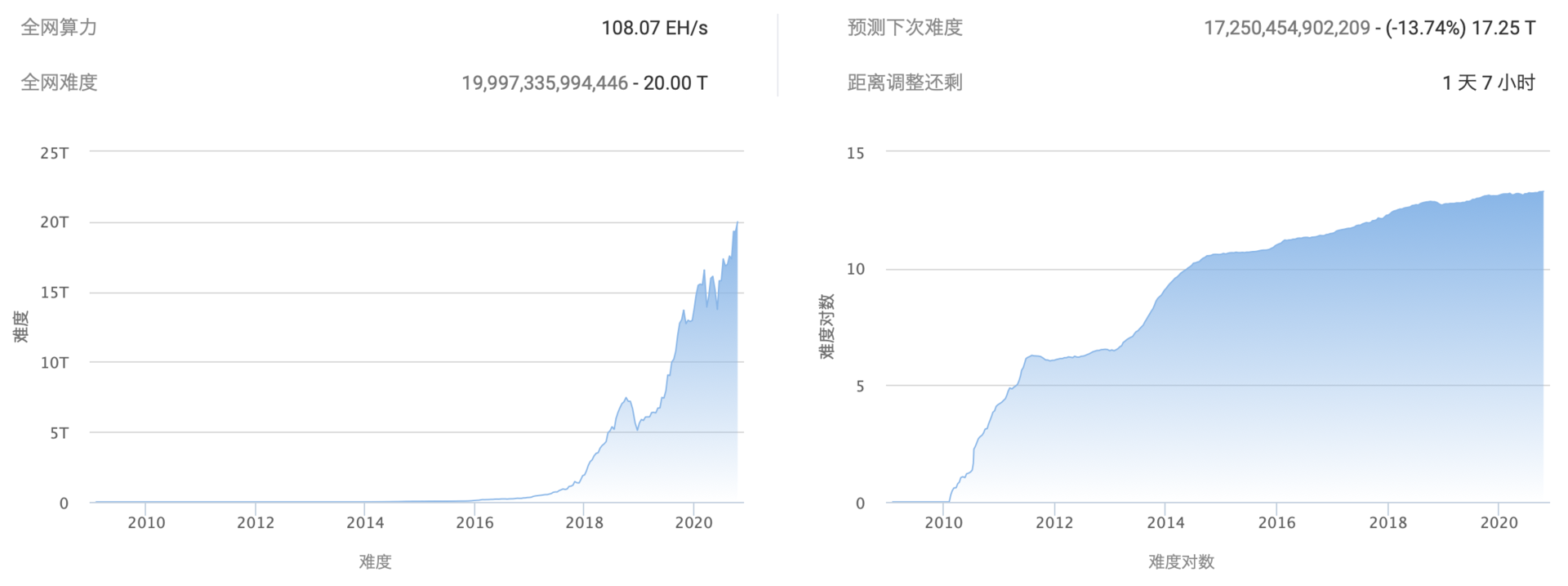

According to BTC.com data, after dropping by 8%, Bitcoin's computing power continued to drop by 19% this week to 108EH/s, a cumulative drop of 23% from the high two weeks ago. In response to the drop in hashrate, the difficulty of Bitcoin's hashrate will drop by 13.7% in one day.

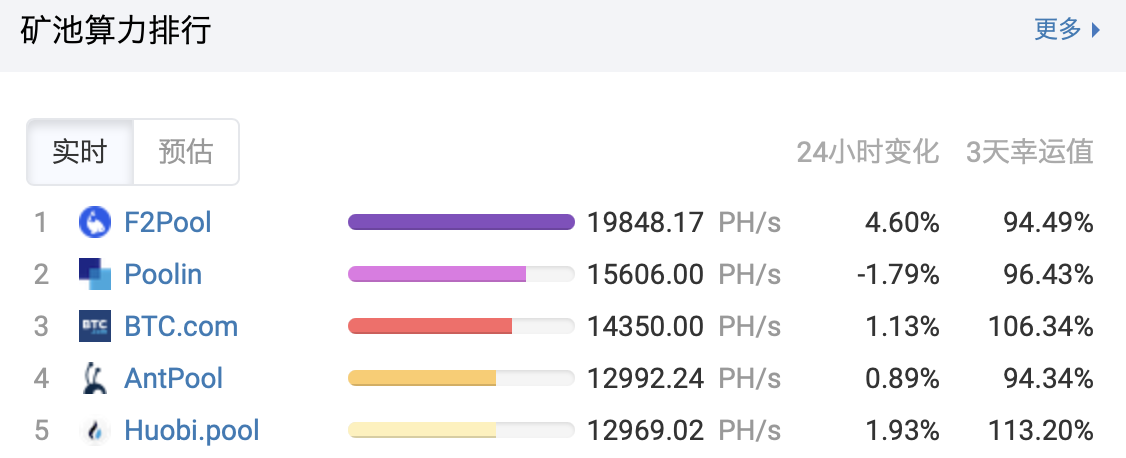

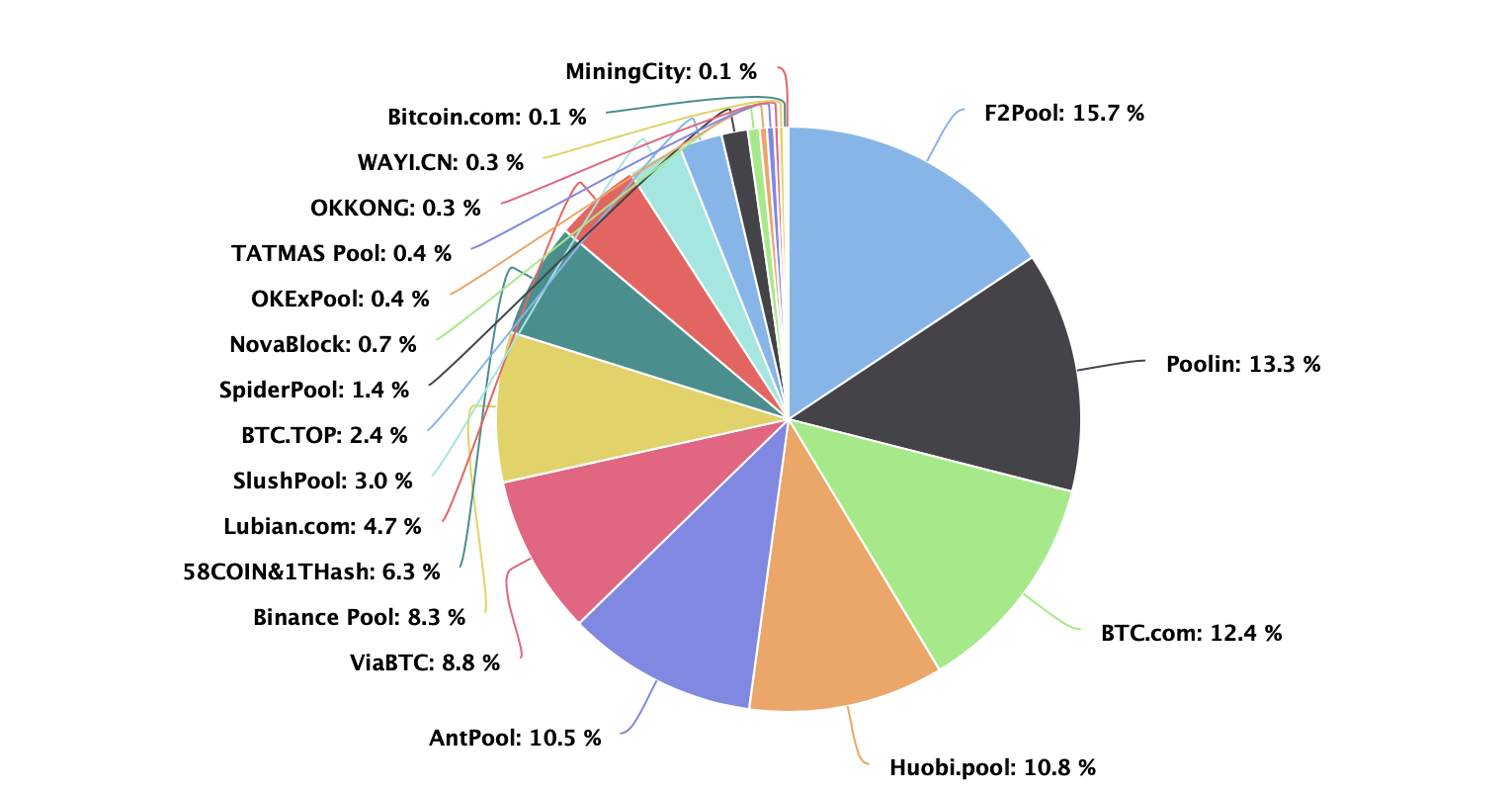

F2pool computing power surged 23%

According to BTC.com data, F2pool has since announced that its real-time computing power is 19.8EH/s, which is an increase of 23% compared to last Monday, almost returning to the state of wet season; its percentage of computing power has also risen from second to second in the past week. One, 15.7%;

Biyin mining pool has since announced that its real-time computing power is 15.6EH/s, which is a slight drop from last Monday; the percentage of computing power has dropped to 13.3%;

BTC.com has since announced that its real-time computing power is 14.3EH/s, a drop of 10% compared to last Monday; due to the relatively high lucky value in recent days, its computing power ratio rose to 12.4% in the past week.

Related news

The 12th Anniversary of the Bitcoin White Paper

On October 31, 2008, Satoshi Nakamoto published Bitcoin's creation paper: "Bitcoin: A Peer-to-Peer Cash Payment System", which is 12 years ago.

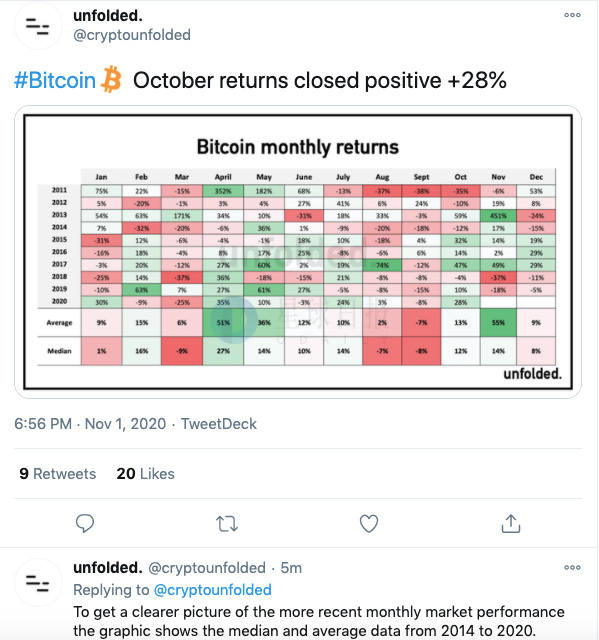

Data: Bitcoin's October revenue reached 28%

Unfolded said on Twitter that data showed that Bitcoin's October earnings reached 28%. Due to the high volatility in the first few years after Bitcoin was born, this performance may be more valuable now.

The Wall Street Journal reports that MicroStrategy invests in Bitcoin

On the evening of October 31, Beijing time, the Wall Street Journal published an article reporting on MicroStrategy’s Bitcoin investment.

The article stated that MicroStrategy could have "get rid of" its remaining cash by paying huge dividends or repurchasing most of its stock. Instead, MicroStrategy bet half of its total assets on Bitcoin. In September 2020, when MicroStrategy announced that most of its remaining cash was used for Bitcoin investment, its stock rose 23% in two days, surpassing its stock performance in the past few years. MicroStrategy CEO Michael Saylor stated that the main purpose of the company's purchase of bitcoin is not to increase the stock price, but to prevent the company's purchasing power from falling. Compared with bonds, stocks and gold, bitcoin is a relatively ideal long-term asset.

Report: BTC rose to 14,000 US dollars, but relevant indicators have not fully followed up

Santiment, a crypto analysis company, stated in a report that Bitcoin's rise to $14,000 was unexpected, and public sentiment turned into optimism and excitement. However, data shows that Bitcoin-related network activities and daily activity addresses have not fully followed up.

Opinion: Lightning network vulnerabilities continue to hinder Bitcoin scaling solutions

Although Bitcoin prices hit some highs in 2020, a large number of crypto supporters have been complaining about the backlog of mempools and the high fees required to send transactions. At the same time, the Lightning Network is far from being widely adopted because the LN software is too difficult for ordinary users, many applications are hosted, and many vulnerabilities have been disclosed this year. (Bitcoin.com)

Opinion: Bitcoin memory pool has returned to the level after the bubble burst in early 2018

Unfolded said on Twitter that the Bitcoin memory pool has now returned to the level it was after the bubble burst in early 2018.

Research: COVID-19 triggers investors to buy Bitcoin

A recent study jointly conducted by Grayscale and 8acre Perspective showed that 83% of those who bought Bitcoin made the investment last year. In addition, 38% of Bitcoin purchasers purchased Bitcoin in the past 4 months, indicating that the epidemic prompted investors to purchase Bitcoin. This period of time coincided with the beginning of the lockdown and quarantine regulations caused by the epidemic.

The Italian multinational energy giant Enel Group recently encountered a ransomware attack. Its computer network was infected with a Windows ransomware called NetWalker. It is reported that NetWalker hackers released screenshots of approximately 5 TB of stolen data and threatened to release the first batch of data within a week, thereby forcing Enel Group to pay 1,234 bitcoins (about 16.8 million US dollars).

No comments:

Post a Comment