The continued expansion of losses contrasts with high valuations and unicorn halo.

As a company that started with AI voice, Yunzhisheng is fortunate to be sought after by the capital market during the AI investment frenzy. Behind the high valuation, it is also trapped in the vicious circle of "the higher the valuation, the more difficult it is to prove self-worth with income". Even in the fierce market competition, constantly changing directions, but in the face of the uncertainty of the artificial intelligence industry and continuous losses, it is still facing a huge test.

On November 3, Yunzhisheng Intelligent Technology Co., Ltd. ("Yunzhisheng") formally submitted a prospectus to the Science and Technology Innovation Board, and plans to be listed on the Science and Technology Innovation Board.

Yunzhisheng was first established in 2012. Since its establishment, it has completed 8 rounds of financing, with a valuation of 1.2 billion US dollars, and put on the unicorn halo early. Yunzhisheng, which started with voice technology, is no longer a single smart technology supplier, but a comprehensive IoT solution provider, expanding the general AI chip and cloud edge market.

In 2019, according to the "China Unicorn Report 2019" released by the China Evergrande Research Institute, Yunzhisheng is valued at US$1.2 billion, ranking it among the unicorns.

In the prospectus recently disclosed by Yunzhisheng, this unicorn with a valuation of up to 1.2 billion US dollars showed its true appearance for the first time.

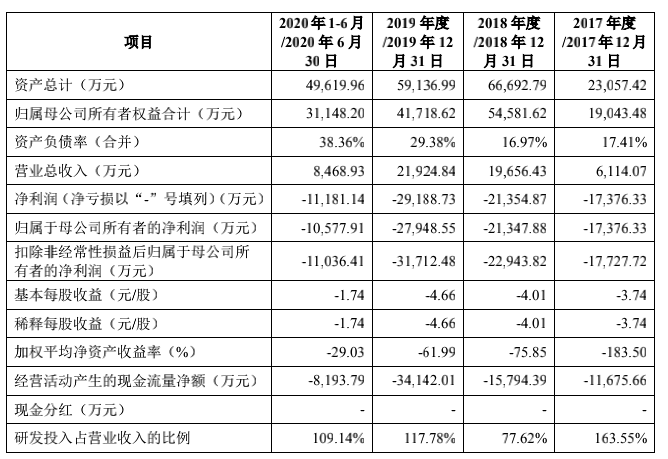

Judging from the report data, Yunzhisheng has accumulated a loss of 790 million yuan in the past three and a half years. The risk warning section of the prospectus mentioned that “the company suffered a significant loss during the reporting period and is not expected to achieve profitability in the short term, and the uncovered loss will continue to expand. If the unprofitable state continues, it may trigger delisting conditions.”

At present, the commercialization of Yunzhisheng has not yet fully completed. The continued expansion of losses is in contrast to its high valuation and unicorn halo.

The hidden worries behind a loss of 790 million yuan in three and a half years

Yunzhisheng was first established in 2012, and it took eight years to become an AI unicorn in the voice field. But there are hidden worries in the process of becoming a unicorn.

According to the prospectus, from 2017 to 2019, Yunzhisheng's revenue was 61.140 million yuan, 197 million yuan and 219 million yuan, and its corresponding net losses were 173 million yuan, 213 million yuan and 279 million yuan, respectively. In the first half of 2020, it achieved revenue of 84.689 million yuan and a net loss of 106 million yuan.

In three and a half years, the accumulated loss amounted to 790 million yuan.

According to the prospectus, as of June 30, 2020, Yunzhisheng has undistributed profits of -463 million yuan. "In the next period of time, it is expected that the company's unrecovered losses will continue to expand, and the division of cash will not be possible, which will have a certain degree of adverse impact on shareholders' investment income." The prospectus stated.

The trouble is that the epidemic has also slowed down Yunzhisheng's business development speed and seriously affected its financial performance.

According to the prospectus, in the first quarter of 2020, Yunzhisheng achieved main operating income of 23,458,500 yuan, a 46.44% decrease from the same period last year.

The most direct impact is that Yunzhisheng’s business for hospitals, home appliances, and commercial real estate customers, including Yunzhisheng’s voice medical record system for hospitals, medical record quality control systems and other products, has been delayed; home appliance customers’ demand for smart voice accessories fall; and a wine shop Chi can upgrade requirements of delay and so on.

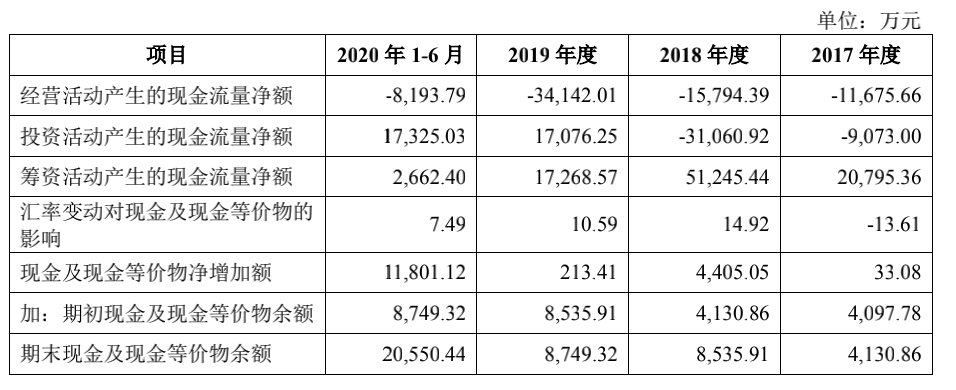

The more serious data than continuous loss is the performance of cash flow generated by operating activities.

According to the prospectus, the net cash flow generated by Yunzhisheng’s operating activities has been negative, and the net cash flow outflow from 2017 to 2019 has been increasing, reaching 340 million yuan in 2019, indicating that there is a relatively Risks of excessively high accounts receivable or high inventory levels.

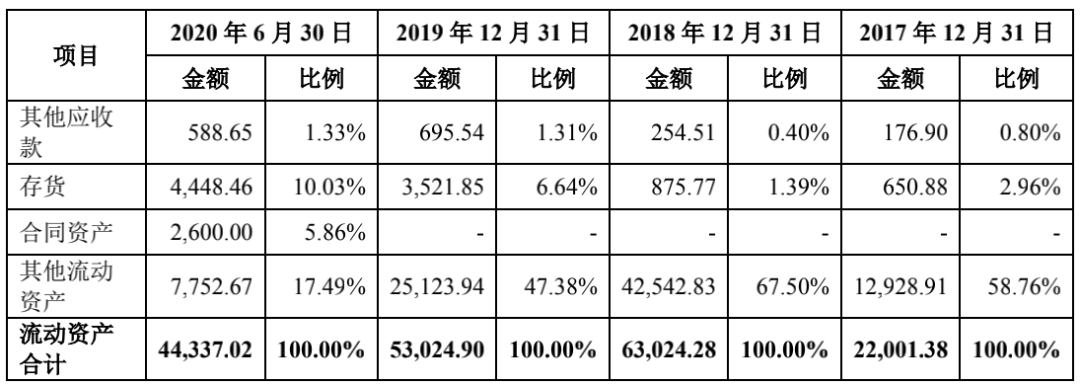

In terms of inventory value, in the first half of 2020 alone, Yunzhisheng’s inventory value increased by 9.26 million compared with last year. Inventory mainly includes raw materials, inventory goods, and products issued, including chips used in the production of Internet of Things voice interactive products, PCBA board microphones and other hardware components, and unsold voice interactive products.

Yun Zhisheng did not specifically explain the inventory situation in the first half of 2020 in the prospectus. However, it is stated in the prospectus that there are more hardware in the overall solution in 2019, and the acceptance is not completed at the end of the year, resulting in a rapid increase in the amount of unissued goods.

In the absence of profitability, before the listing, the source of funds for Yunzhisheng's operating business was mainly external financing. Since its establishment, it has completed 8 rounds of financing, setting a record for the highest single round of financing in the voice technology field, and the highest round of financing in D.

The prospectus shows that as of the first half of 2020, Yunzhisheng has a cash and cash equivalent balance of 205 million yuan and a debt-to-asset ratio of 9.16%, which is only suitable for short-term and daily non-interest-bearing debt.

Long-term sustained losses and excessive accounts receivable have almost become pain points for AI companies. In view of the industry’s high technical barriers, long R&D cycle and high investment, if Yunzhisheng’s R&D direction and product positioning do not meet market expectations, it is likely to cause huge risks.

R&D investment equals revenue

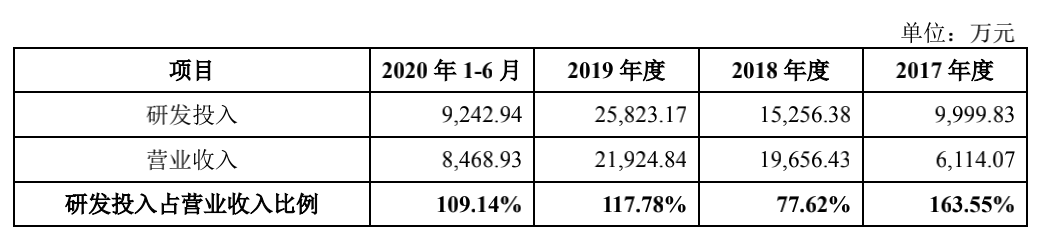

With continuous losses, Yunzhisheng's R&D investment costs are quite high. It’s no surprise that R&D investment is high in the AI industry, but Yunzhisheng’s R&D investment can almost be equal to revenue.

The prospectus shows that Yunzhisheng’s cumulative R&D investment accounts for 107.4% of cumulative operating income, and the proportion of R&D expenditures is higher than the industry level, and the scale of R&D expenditures has grown rapidly.

In 2017, Yunzhisheng invested nearly 100 million yuan in research and development expenses, accounting for 163.55% of operating income. In 2019, R&D expenditures remained high, with R&D investment reaching 258 million yuan, accounting for 117.78% of operating income. Research and development expenses mainly include salary and labor service fees, and technical service fees.

In the first half of 2020, the average number of R&D personnel of Yunzhisheng is 325, and the per capita salary of R&D personnel is 174,300 yuan. R&D personnel accounted for 68%.

However, where did the large investment in research and development go?

In the prospectus, Yunzhisheng listed the status of projects under development as of June 30, 2020, and the heart of the machine only selected a few projects with a large investment amount, mainly focusing on the "cloud side".

The AIOS service open platform is mainly used in the fields of smart travel, smart education, and smart home. It has invested 51,775,100 yuan with 79 people.

The research and development of artificial intelligence accelerators and chips for the Internet of Things is mainly used in interactive scenarios and product directions such as smart homes. It has invested 62.764 million yuan and 96 people have been invested. ·

Vehicle-level language artificial intelligence chips and solutions. Design and develop vehicle-level voice AI chips for the automotive pre-installation market, and verticalize this chip with Yunzhisheng’s artificial intelligence software engine and vehicle-level artificial intelligence solutions. Integration to form a complete cloud-core integrated solution. Mainly used in the field of smart travel, 33,0021 million yuan has been invested, 112 people have been invested, and the budget is 55 million yuan.

In addition to the solution, it is worth noting that Yunzhisheng has also invested heavily in artificial intelligence chips.

As early as 2018, Li Xiaohan, vice president of Yunzhisheng IoT Business Unit, told the media that he would invest in chip research and development regardless of cost. At present, the AI chips "Swift" and "Hummingbird" series for IoT scenarios have begun mass production and large-scale sales, and "Snow Leopard" automotive-grade chips are still undergoing stability tests.

In the AI chip and car-level chip market for IoT scenarios that Yunzhisheng is targeting, competitors are also constantly sneaking in, and the utility needs to be tested.

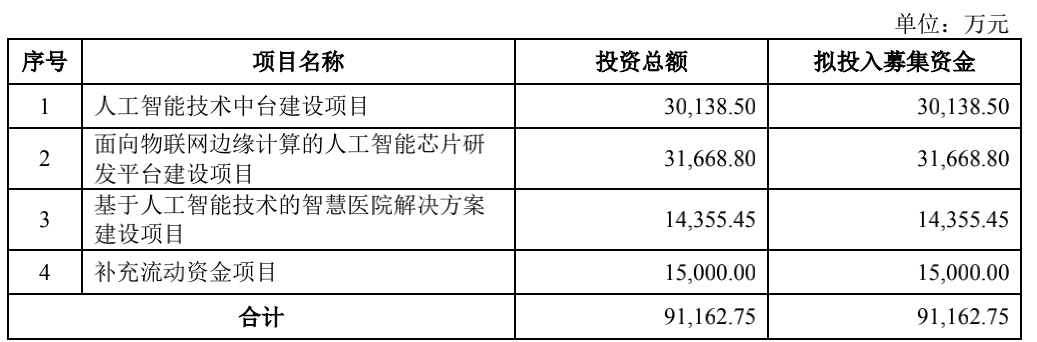

At the same time as the listing acceptance is approved, Yunzhisheng intends to raise about 912 million yuan of funds, of which 317 million yuan is planned to be used for the construction of the "artificial intelligence chip research and development platform construction project for edge computing of the Internet of Things". The construction period is three years. , The construction front is longer.

Currently, Yunzhisheng currently focuses on three major businesses, including intelligent voice interactive products, intelligent IoT solutions, and artificial intelligence technology services. It provides cross-hardware platforms, cross-application scenarios, and cloud-core integrated IoT voice interaction products. And for industry-level customers.

In the field of smart IoT solutions, it mainly provides integrated smart IoT solutions for specific scenarios such as hotels, communities, residences, and hospitals. This part of the business has become the mainstream income.

When it comes to intelligent voice interactive products, they are mainly delivered in the form of an integrated software and hardware. Yunzhisheng itself does not engage in hardware production, but instead entrusts OEM and ODM suppliers to OEM production.

Yun Zhisheng mentioned in the risk warning that there is a certain risk of improper product quality control when it involves the production of hardware production links entrusted to OEMs.

Ambiguous customer

In the "Partners" column of Yunzhisheng's official website, well-known Internet and server vendors such as China Telecom, Intel, Lenovo, and Qualcomm are listed. Official website shows, cloud-known sound current partners have over 20,000, covering the Internet, mobile Internet, smart appliances, automotive systems, online education, intelligent customer service, smart chips and other fields.

However, among the top five customers disclosed in the prospectus, the partners shown on the official website are not included. Yunzhisheng stated in the prospectus that in the process of changing from a smart single product supplier to a smart IoT solution provider, there are certain changes in major customers and suppliers every year.

In the first half of 2020, the top five customers of Yunzhisheng are mainly in the real estate development and medical fields.

In 2019, 5.49% of Yunzhisheng's revenue came from Tianjin Jinnan New City Real Estate Development Co., Ltd. Until the first half of this year, the company's revenue contribution increased to nearly 30%, making it the largest customer. Real estate giant Shimao Group has consistently ranked among the top five customers in 2019 and the first half of 2020, contributing nearly 20 million in revenue.

In the cooperation with Shimao Group, Yunzhisheng mainly provides AI capabilities, integrating Yunzhisheng’s voice interaction capabilities and smart home solutions. In 2019, Yunzhisheng also established a joint venture with Shimao Group to help real estate realize smart transformation.

It remains to be seen whether the cooperation between real estate and AI companies and the subsequent implementation of the solution can really be used, and how effective it is.

According to Almost Human is understood that in the process of seeking real estate intelligent upgrade, there are cases of real estate cooperate with AI algorithms, security companies, extending to the wisdom of the community, the wisdom of the home court of the scene, there are many Baidu , millet and other Internet giants players, competition fierce.

Yunzhisheng also needs to find its own direction in the fierce market competition, and the commercialization effect of its cooperation with real estate needs to be tested, making its prospects full of uncertainty.

Observe that Yunzhisheng, as a company that started with AI voice, is fortunate to be sought after by the capital market during the AI investment frenzy. Behind the high valuation, it is also trapped in the vicious circle of "the higher the valuation, the more difficult it is to prove self-worth with income". Even in the fierce market competition, constantly changing directions, but in the face of the uncertainty of the artificial intelligence industry and continuous losses, it is still facing a huge test.

No comments:

Post a Comment