Interpretation of the opportunities and risks behind the recluse of AI companies' core-making enthusiasm.

The prelude to the new wave of AI listings has just begun.

What are the common characteristics of these companies sprinting for IPO? Chips are obviously a topic that cannot be avoided.

Branch board has been disclosed in the prospectus cloud-known sound and in accordance with plans of Science and Technology , has started listing counseling cloud from science and technology , the sky Li Fei , and has started Pre-IPO round of financing will think Chi , are involved in AI chip research and development.

The research and development of chips seems to have become the business standard of this AI listing wave, and it is also a key shining point for AI startups to attract capital.

Unlike pure AI chip companies, these celebrity startups who have been cultivating AI algorithms for many years do not use the sales of chips as their core source of revenue. Instead, they hope that chips, algorithms, and applications can form a synergy to achieve higher competitiveness. Combination punches.

Behind this cross-border core-making craze for algorithm companies, what kind of chess are AI companies playing?

01 Positioning changes, core AI companies are not just algorithm companies

From the beginning of the chip research and development plan, AI startups can no longer be simply called AI algorithm companies.

In the prospectus, in accordance with plans he calls himself a world- leading AI companies to AI chip technology and algorithm technology as the core technology, research and development and sales force calculation includes AI hardware and software solutions, including AI.

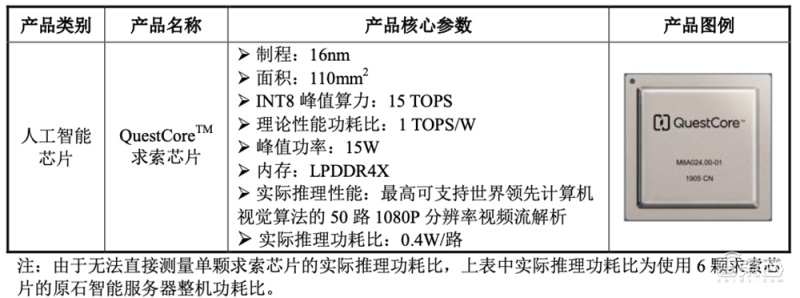

In addition to the layout of computer vision, speech recognition, and natural language understanding algorithms, Yitu launched the cloud AI reasoning chip "search" in May 2019. The chip has passed Yitu's urban vision center, smart community, and "one face connects the city." And other solutions are applied.

Yitu focuses on the cloud, while several other companies focus on terminal chips.

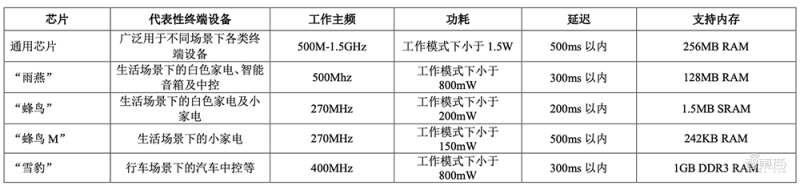

Focusing on intelligent voice, Yunzhisheng began to deploy end-side AI voice chips in 2015. In 2018, it was the first to deliver the "Swift" series of chips and "Hummingbird" series of chips for home scenarios. In 2019, it launched the car-grade "Snow Leopard" chip.

The first two types of chips have been mass-produced, and "Snow Leopard" has entered the Geely Automobile product stability test and vehicle regulation test stage. After passing it, it is expected to be launched on Geely Automobile's mainstream platform.

Among several other AI vision startups that are still waiting for their listing applications to be accepted, Yuntian Lifei launched its self-developed neural network processor chip "Yuntian Chuxin DeepEye1000" in November 2019. This SoC chip has a built-in neural network processor with independent property rights, Alibaba Pingtou Xuantie 810 embedded processor and a dual-core vision DSP processor, which can track 1,200 faces per second.

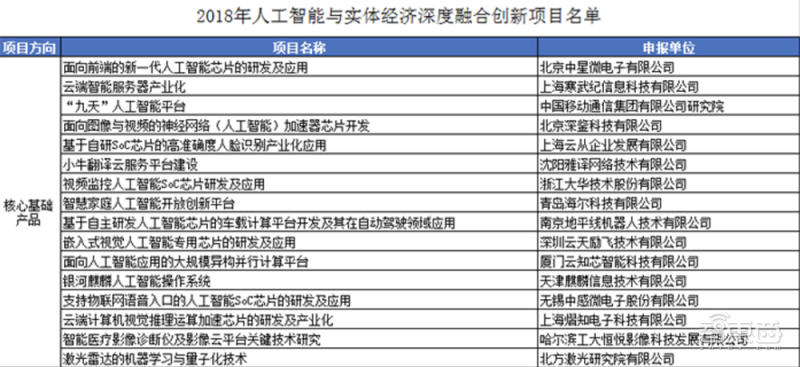

Clouds from technology not officially declared the official chip R & D program, but in 2018 the Ministry announced the integration of artificial intelligence and the real economy depth list of innovative projects, from cloud technology "based on self-developed SoC chip Micro Motion Accuracy face recognition industrialization Application" is impressively listed.

Spitz, which launched the Pre-IPO round of financing, also launched its first voice terminal AI chip Shen Cong TAIHANG series in January 2019, hoping to achieve the integration of algorithm + chip.

It can be seen that these AI startups unanimously regard AI chips as a core element to enhance future competitiveness.

For companies engaged in the AI industry, the main benefits of self-developed chips are threefold: one is to improve the utilization of computing power through the collaboration of software and hardware, the other is to optimize functions for specific application scenarios, and the third is to save costs and improve cost performance.

In addition to some AI startups, many cloud computing giants and technology companies at home and abroad have begun to try self-developed chips, or cooperate with traditional chip manufacturers to develop chips.

And if the competition hard power, technology giants in reserve funds, personnel gather energy collecting aspect force, floor scale, etc. all have natural advantages, it also means creating AI companies large investment, high risk, long payback periods in road-making core, Often face greater pressure.

02 How much blood does AI chip research and development shed?

The development of AI chips inevitably requires heavy investment.

The prospectus documents of two AI startups, Yunzhisheng and Yitu, both show that AI chips account for a considerable proportion of their R&D investment.

From 2017 to the first half of 2020, Yunzhisheng’s prospectus showed that its investment in AI dedicated chips was 5.5309 million yuan, 11.6693 million yuan, 60.711 million yuan and 17.55 million yuan, accounting for 5.5% and 7.6 of the total R&D investment in the same period. %, 23.5%, 18.99%.

In terms of specific research projects, Yunzhisheng has invested 96 people and 62.764 million yuan in the "Internet of Things artificial intelligence accelerator and chip research and development" project, and 112 people and 33,002,100 yuan. The combined investment has exceeded 95.46 million yuan, accounting for 15.8% of R&D investment in the same period.

Yitu did not separately list its investment in chips in the prospectus. As of June 2020, its "artificial intelligence chips and cloud-side computing power hardware products" project has invested 339.9 million yuan, an "artificial intelligence-based urban vision center platform" The project has invested 608 million yuan. Both projects involve chips and computing power-related products, which together account for 66% of the total investment in major research and development projects.

Looking to the future, in the two fund-raising plans, AI chip research and development projects account for the highest proportion of the total fund-raising.

Among the funds raised this time, Yunzhisheng intends to invest about 316.7 million yuan for the construction of the "artificial intelligence chip research and development platform construction project for edge computing of the Internet of Things" with a three-year cycle. This investment amount accounts for about the total funds raised. 34.7% of the amount, the highest proportion.

In fundraising purposes, Yitu plans to invest 2.318.2 billion yuan in the "New Generation Artificial Intelligence IP and High-Performance SoC Chip Project", accounting for 30.89% of the total fundraising. The "Edge Computing System Project Based on Visual Reasoning" also involves chips and hardware products for edge AI computing, with an estimated investment of 811.1 million yuan, accounting for 10.81% of the total funds raised.

03 Can core making drive up business performance?

After investing heavily in chip research and development, what kind of returns did AI companies get?

Judging from the data disclosed in the prospectus, Yitu's search chip was released in 2019. With the promotion and application of AI computing power hardware products based on the search chip and algorithm technology, Yitu's revenue in 2019 was more than twice that of the previous year. , Even with the new crown epidemic in early 2020, Yitu’s revenue from January to June 2020 increased by 50.62% year-on-year.

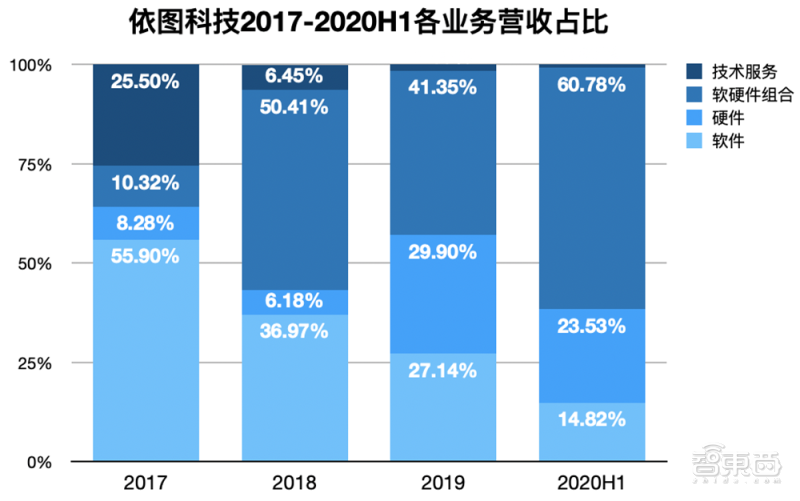

From the revenue share of each business, we can also see that the sales revenue of Yitu’s hardware and software and hardware portfolio solutions during the reporting period were 12.78 million yuan, 172.2 million yuan, 510.8 million yuan and 320.9 million yuan, respectively. The ratios were 18.60%, 56.59%, 71.25% and 84.31%, and the proportions were gradually increasing.

Yunzhisheng started to launch chips in 2018, and its revenue from 2017 to the first half of 2020 was 61,140,700, 196.6, 219.2, and 84,689,300 respectively.

The gross profit margin of the two companies has also increased year by year. According to the prospectus, the gross profit margin of Yitu during the reporting period was 57.39%, 54.55%, 63.89% and 70.99%. The gross profit margin of Yunzhisheng, which focuses on the intelligent voice track, is relatively low, being 11.41%, 24.97%, 26.28% and 31.66% respectively.

Yunzhisheng pointed out in the prospectus that one of the reasons for the significant rebound in gross profit margin in the first half of 2020 is the sales of the "Hummingbird" series of chips.

Due to the large-scale promotion of self-developed chip products and the abandonment of products with lower gross profit margins, in the first half of 2020, the direct hardware procurement cost of Yunzhisheng’s intelligent voice interaction products fell to 26.17%. In contrast, Yunzhisheng The corresponding cost ratio of sound in 2017-2019 is more than 60%.

It seems that the implementation of chips can indeed bring a positive impact on AI startups.

04 Where is the chip team formed? Subsidiary becomes the main force

Recruiting talents is the key to the success or failure of core manufacturing. The sources of chip development teams of several AI startups can be divided into different types.

The core technical personnel led by Yunzhisheng to build the core are mostly technical experts in the field of speech processing. Its chairman and deputy general manager Liang Jiaen led the team to realize the optimization of AIoT interactive chips; its director and senior vice president of research and development Li Xiaohan began to build Yunzhisheng's chip research and development team in 2016, and successively launched three AI voice chips for the Internet of Things; Director and R&D Director Li Peng has participated in the research and development of Yunzhisheng’s first IoT AI chip since 2016.

Yunzhisheng also co-invested with Geely Holding Group’s strategic investment and independently operated technology innovation company Yikatong Technology to jointly invest in the establishment of Xinzhi Technology , and Xinzhi Technology announced in January this year that its first automotive-grade full-stack voice AI chip was successfully taped out. .

In addition to independent research and development, Yunzhisheng also cooperates with Duke University to research AI chip compression and quantization technology and non-Feng new AI chip computing architecture. It invests US$50,000 in the project every year and the project cycle is 3 years.

Spitz and SMIC jointly invested in the establishment of Shanghai Shencong Semiconductor Co., Ltd. in March 2018. It began tape-out in August of the same year, lit up verification in November, and officially launched its voice AI chip in January 2019.

The core figure in making the core according to the map is also an algorithm expert. Its director and chief architect Lin Chenxi led the team to complete the research and development of AI computing products such as smart servers and solutions for smart cities and smart commerce, and overcome major engineering issues such as AI chip architecture and the productization of algorithm technology.

Yitu’s first-generation AI chip search is a joint research and development with AI chip startup Yizhi Electronics. As of August 2019, by signing an agreement with Yizhi Electronics, Yitu has obtained 100% intellectual property rights for the first-generation search chip and hardware system. And any related rights. Starting from April 2020, Yitu AI chips will be fully self-developed, and all the work from design to post-production verification can be completed within the company.

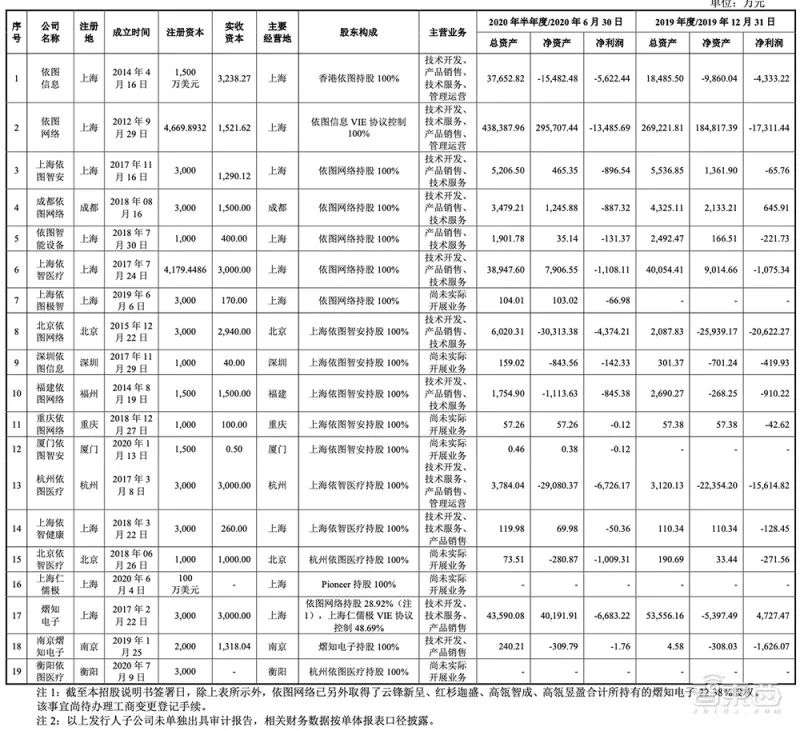

According to the prospectus, Yizhi Electronics has become one of Yitu's 19 domestic holding subsidiaries, with 28.92% of the shares held by Yitu Networks.

Yuntian Lifei laid the chip earlier. In 2014, it had a complete "machine learning and visual intelligence processor" AI chip solution. The research and development of the first generation of deep learning neural network processor NNP100 was completed in 2016, and the second generation of IPU Filmed in August 2018.

The founder and CEO of Yuntian Lifei revealed that its chip R&D team is the top domestic ASIP vector processor chip design team. The main backbone team members have rich vector processor and complex SoC chip design experience, and the average design experience exceeds 10 year.

For example, Li Aijun, the head of Yuntian Lifei’s chip team, was once the head of ZTE’s mobile phone chip research and development. He led the development of the first 28nm mobile phone chip in China and the first domestic LTE multi-mode mobile phone chip. The chief processor architect has also served as architects in international chip giants such as NVIDIA and Intel.

Yuncong Technology has not disclosed the background of its core-making team. Perhaps we will see more information in the prospectus to be disclosed in the near future.

05 Four advantages of AI company core making

Whether it is focusing on algorithms or chips, AI startups have reached a key node that has withstood the test of the market.

In general, AI companies involved in chips can reap multiple benefits from policy, capital, landing, and business expansion.

1. Policy advantage: dual policy support

In the freshly released "14th Five-Year Plan" and the 2035 long-term goal, it is clearly pointed out that it will target the frontier fields such as artificial intelligence and integrated circuits and implement major national scientific and technological projects.

The continued increase in policies is obviously very beneficial to AI startups with two-wheel-drive algorithm chips.

2. Capital advantage: investment is tilted towards AI hardware

In the past two years, the overall investment scale of the AI industry and the number of financing incidents have dropped significantly. According to ICBC Investment Bank data, the total investment and financing amount of the AI industry in 2019 was nearly cut to 172.1 billion, and the number of transaction incidents dropped to 1,050, becoming more and more heady Or concentration of high-quality enterprises.

The AI hardware industry is showing the opposite trend. In 2019, the domestic investment in AI chips alone reached 5.857 billion yuan, an increase of more than 90% year-on-year.

AI companies such as Yuntian Lifei, Yitu Technology, Spitz, and Horizon, which take into account both algorithms and chips, have all received a single financing of more than 100 million yuan in the past two years.

3. Landing advantage: there are specific application scenarios

Compared with pure AI chip companies, one of the major advantages of AI startups to build cores lies in their proximity to application scenarios and deep cultivation of AI algorithms, so they can have a deeper understanding and grasp of the computing power demands of different applications and models, and also grasp a certain scale of implementation. Application resources.

An industry source said, the algorithm will self-developed chips and packaged algorithms, are often able to tap more Dolly profit space.

4. Business development: building a new moat

Now that the AI industry is still in its infancy, no one can assert which business model is more feasible. For AI startups, getting involved in chips also means widening the moat.

Take Yunzhisheng as an example. In the past two years , as technology giants such as Baidu and Xiaomi have increased their investment in consumer-grade smart hardware, Yunzhisheng’s profit margin in the field of intelligent voice interaction has been squeezed. In this regard, Yunzhisheng has turned to vigorously promote the voice module solution based on self-developed AI chips, looking for new growth points in white appliances, which are relatively less competitive.

Affected by this, the shipment volume of Yunzhisheng's intelligent voice module has dropped sharply in the first half of 2020, and the self-developed chip has passed the stability test of a number of small home appliance manufacturers and gradually mass-produced, and the sales situation has gradually opened up. In the first nine months of this year, its cumulative chip shipments reached 924,400.

06 The risks behind recluse in core making

For AI startups that invest in chip research and development, the problem is also obvious. Core making is a high-risk thing. Once it fails, the tens of millions of dollars invested will be wasted.

In other words, if AI startups want to persist, they must solve the problems of money, talent, and landing.

To create chips optimized for core application scenarios, professional chip design capabilities and practical experience are the key. Therefore, most of the founders of AI chip entrepreneurs are industry veterans who have been in the chip field for more than ten years, and the chip design team should try their best Absorb elite and powerful generals.

Considering that software is the link with customers, several AI startups involved in core manufacturing have far-reaching plans. On the one hand, they promote chip research and development, while on the other hand, they strive to improve the ease of use of the adaptation tool chain and application middleware.

For example, in order to lower the development threshold, YITU provides a full set of development middleware such as high-performance computing libraries and high-tech tools. It is also advancing the decoupling of the platform algorithm layer from the hardware layer, data layer, and application layer. Pluggable AI chip vision innovation platform architecture.

At the same time that Yuntian Lifei launched the end-side AI chip last year, it proposed an open AI ecological plan of "complete hardware in one week, adaptation algorithm in one week, docking service in one week, and finally AI capability completed in one month."

After the chip is built, even if it achieves the expected more suitable performance and higher cost performance, there are still many challenges.

From the perspective of product portfolio, if the end-to-end vertical integration solution of "chip + algorithm" makes it easy for customers to use, the continued use of subsequent customers will bring stable income to AI companies, but in case there are some shortcomings in the chip, such as If the iterative update of the algorithm is well supported, then the customer may also abandon the entire solution due to performance issues.

From the perspective of the competitive environment, the competitors facing AI startups include Internet giants that gather high-quality data and talent teams, and chip giants that have accumulated abundant customer resources and invested in algorithm research. Some AI chip startups have also begun to expand their business to AI algorithms and finding differentiated positioning in the market are crucial to the long-term survival of AI startups.

From the environment point of view, despite a favorable domestic policy, but a number of AI record companies have been included in the US list of entities, such as Kagome country's exports further tighter controls may affect the company's future business.

07 Conclusion: The road to core making still needs time to verify

As the AI industry gradually returns to its commercial nature, every AI company is about to face the big test of survival of the fittest in the market. Core making may become a powerful assistant for AI companies to strengthen their core competitiveness , or it may become a "golden beast" that drags down cash flow. Whether it can bring more profit through core manufacturing depends on the strength of the products that are ultimately delivered to the market.

In the early stage of development of the AI industry, R & D and market development will take time, short-term profit and loss does not mean anything, but to find the right technical direction and business model, really positive solutions to customer problems, an AI will be about the future of the company.

No comments:

Post a Comment